In terms of life insurance, the market here is quite developed in Canada as many providers make customized solutions, whether you desire a term life or a whole life, with universal policies that have to make the right fit for your family’s financial safety. This post covers some of the best insurance companies in the country, featuring what you will look for from each.

Why Life Insurance Matters

Life insurance is a critical component of financial planning. It is a safety net for your family in terms of such situations as clearing debts, living costs, or long-term targets, like education, before the policies lapse. For Canadian families, life insurance also protects against such unexpected events, providing peace of mind and financial security.

Key Factors to Consider When Choosing a Life Insurance Company

Let us begin with the list of top providers; there are criteria that separate one insurer from another:

- Financial Strength: Companies with high ratings through agencies such as AM Best, Fitch, or Moody’s show an ability to fulfill claims.

- Policy Options: Check if the company provides a number of policies, in term, whole, or universal life insurance.

- Customer Service: Great service means easy setup of the policy and claims process.

- Premium Rates: Low premium rates that suit your budget are essential.

- Customization: Look for flexible riders or add-ons, such as critical illness coverage or disability benefits.

- Digital Tools: Many insurers now offer online calculators, apps, and portals to simplify policy management.

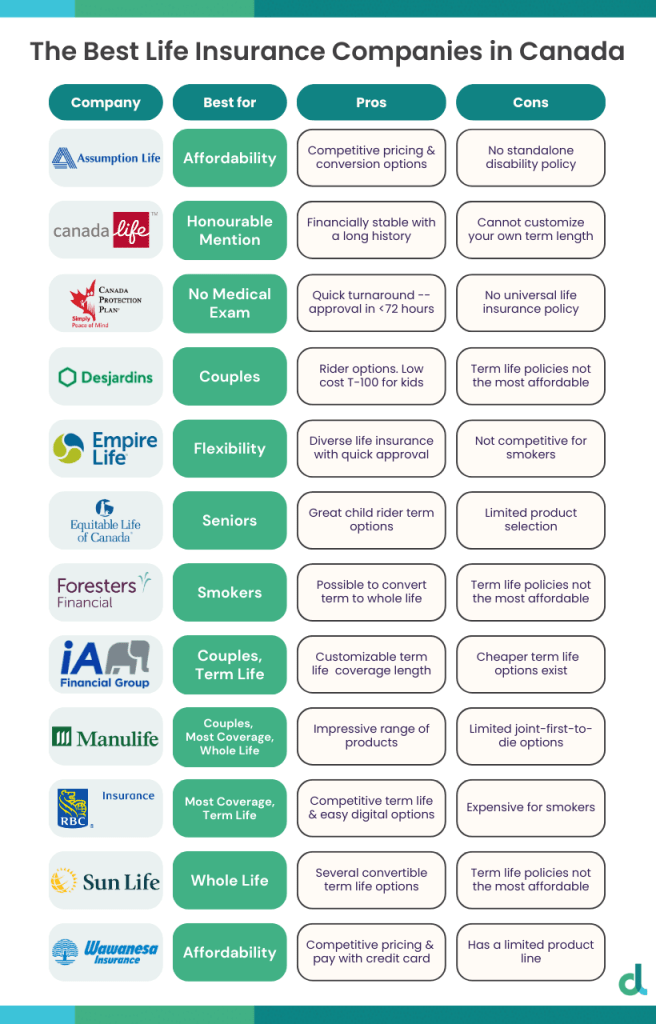

Best Life Insurance Companies in Canada

Canada Life

Canada Life is among the oldest and most trusted names in the industry. It is an organization renowned for its holistic policies that will cater to the different needs of the family, from term life policies to the policy plans of whole life and universal life.

Strengths:

- Customizable policies with riders like critical illness and disability.

- Covers strong financial ratings and over 170 years of legacy.

- User-friendly online tools for policy management.

Best For: Families and individuals searching for reliable, long-term coverage.

Sun Life Financial

Sun Life is an international financial services company that provides insurance and wealth management services. In Canada, Sun Life offers a diversified range of life insurance options.

Strengths:

- A variety of term and permanent life insurance yields.

- Other products like health and dental coverage.

- Ingenious digital products, including mobile apps and online calculators.

Best For: People who appreciate the convenience and technology used for full-fledged insurance and investment services.

Manulife

Manulife stands out for its flexible policies and robust customer support. It is particularly popular among Canadians seeking a combination of insurance and investment options.

Strengths:

- Offers term life, whole life, and universal life insurance.

- Vitality Program rewards healthy living with discounts.

- Extensive international presence, ideal for expats.

Best For: Health-conscious individuals and those who value rewards for healthy behavior.

RBC Insurance

Backed by the Royal Bank of Canada, RBC Insurance is a trusted name offering competitive life insurance products with added perks.

Strengths:

- Simple-term life policies with convertible options.

- Excellent customer service and strong financial backing.

- Discounts for bundling with other RBC products.

Best For: RBC customers looking for seamless integration with their banking services.

Desjardins Insurance

Desjardins is a cooperative financial group that offers a variety of insurance and financial services. Because of its focus on community and client needs, it is a great option.

Strengths:

- Affordable term life insurance options.

- Full customer support in English and French.

- Flexible terms and riders are available.

Best For: Bilingual Canadians and anyone looking for inexpensive premiums.

Empire Life

Empire Life focuses on streamlined, no-frills policies, with a lot of emphasis on customer satisfaction.

Strengths:

- Affordable, easy-to-understand policies.

- Strong emphasis on personalized service.

- Digital tools for fast policy quotes and management.

Best For: Those who value simplicity and excellent service.

How to Choose the Right Life Insurance Provider

Even though the companies mentioned above are some of the best in Canada, the choice of the insurer depends on the individual’s requirements. Here are a few suggestions to help make the right decision:

- Determine your insurance needs. Determine if you will need short-term coverage or long-term security or possibly some combination of both.

- Compare quotes. You can easily do this online or use a broker to find the best quote.

- Read reviews. Consumer reviews will give you an idea about the strengths and weaknesses of the company.

- Seek a financial advisor. This person can help align your policy to your overall financial goals.

Conclusion

Life insurance is not a financial product solely but also a contract that can ascertain the future for your loved ones.

Choosing one company can be any type of a very good and long-term solution between Canada Life, Sun Life, or Manulife: ensure that anything you do your loved ones will all be okay when something goes terribly wrong. Just take some extra time, instead of hesitating to go on the road of perfect choice through consultation with the respective professionals.

Remember, the best life insurance company for you is one that can meet your needs and budget while providing reliable coverage and excellent customer support. With the right provider, you can focus on what really matters: living your best life while knowing your loved ones are protected.