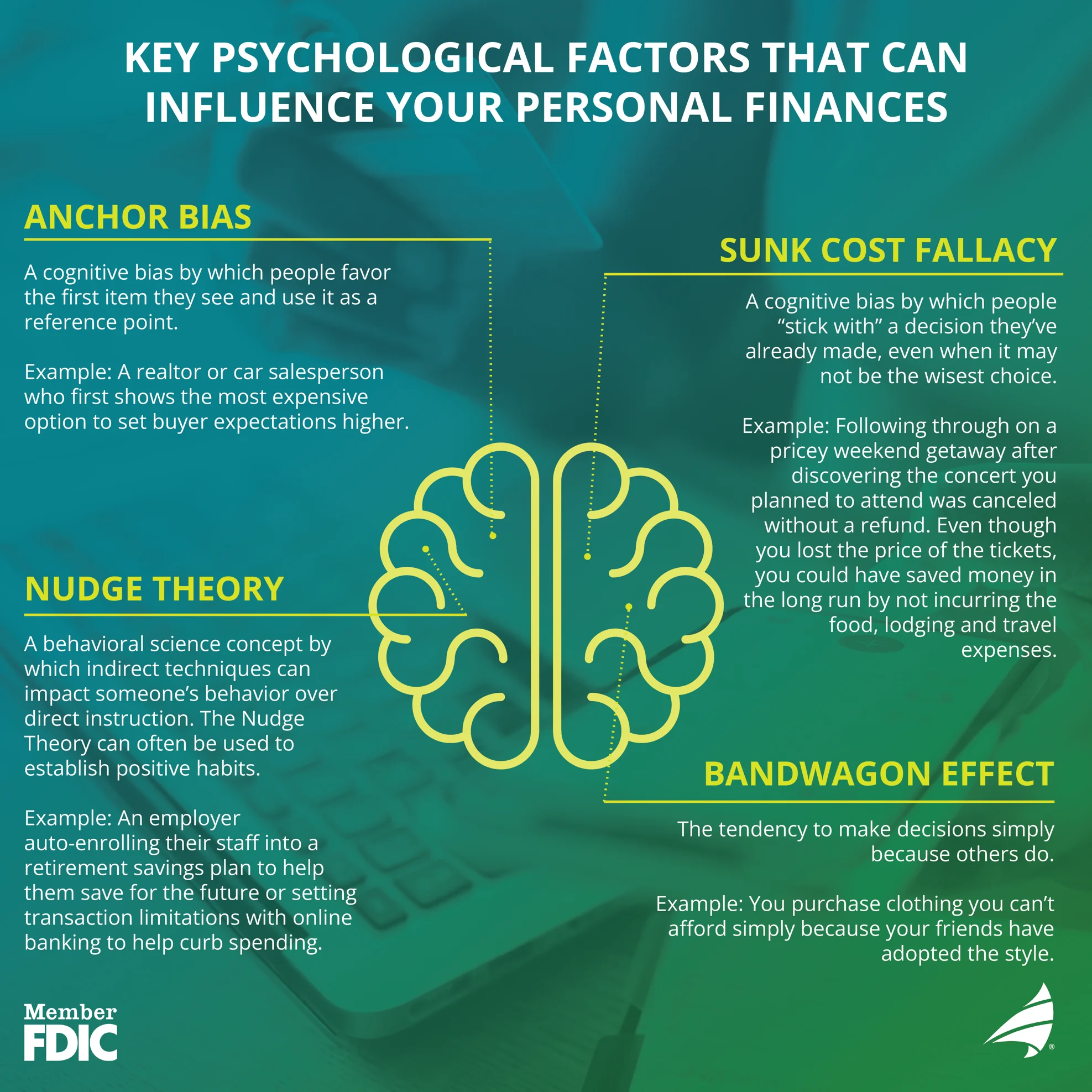

Sound money management is the cornerstone of long-term financial security and peace of mind. Saving money, however, is not always simple to accomplish; it entails overcoming psychological and emotional challenges at times. Being aware of the psychology behind our spending and saving habits can allow us to implement behaviors that facilitate saving money and make it easy and habitual.

Save Automatically

One of the easiest ways of building savings without ongoing effort is to make the process automatic. With automatic transfers, you will always put aside some of what you make and have fewer opportunities to spend on impulse.

Set Up Direct Deposits:

Have a portion of your paycheck deposited into a savings account automatically. This “pay yourself first” strategy gives the time value of saving priority over spending the money elsewhere.

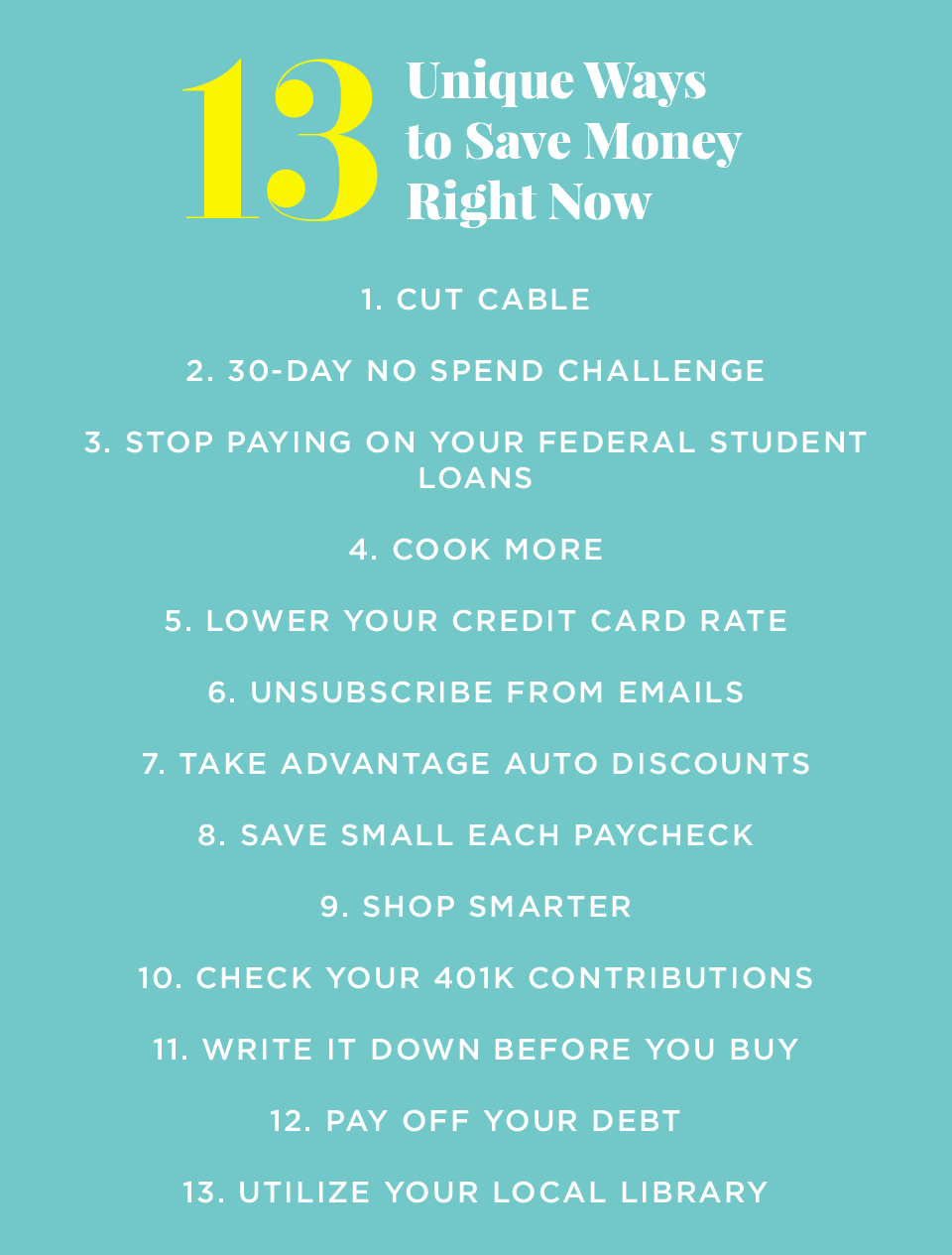

Max Out Employer-Sponsored Retirement Plans:

Contribute to employer-sponsored retirement plans, such as 401(k)s, if your employer offers matching funds. This is not only for your savings but also taps into employer contributions.

Auto-Monthly Transfers:

Establish automatic monthly transfers from your checking to your savings account. The regularity of this habit-forming process ensures the steady growth of your savings.

Enforce a 24-hour Waiting Period for purchases

Impulse buying will divert you from realizing your financial goals. Combat it by using the 24-hour waiting period rule for impulse buys. The strategy compels you to think if the item is a need, most probably causing you to think it is not, thereby averting unnecessary spending.

Invest Small Change Wisely

Savings in spare change would not be much, but over a period of time, it would add up to something significant. If you keep your coins saved and deposit them in your savings account every now and then, you will be able to save money without any difficulty.

Save in Coin Jars:

Keep a jar or a container for loose change. The physical accumulation can also act as a visual reminder for monitoring the savings process.

Deposit Regularly:

Separate and deposit the change every couple of months in your savings account. Not only will this add to your savings, but it will make saving a habit as well.

Use a Checkbook Instead of a Debit Card

In today’s age of technology, it is easy to use a debit card without even realizing the spending is taking place. Writing checks, which is not as prevalent today, takes more effort and awareness.

Track Spending:

Checks make you account for all purchases, so you know where your money is being spent.

Promote Conscious Spending:

Writing a check may give you pause to consider the purchase and help you reduce impulse buying.

Reward Yourself for Financial Discipline

Do not deprive yourself when saving. Incorporate rewards into your financial routine to compensate yourself for being disciplined.

Set Realistic Goals:

Break your savings goals into small, manageable bits.

Celebrate Responsibly:

Reward yourself with something you enjoy and can afford once you have reached a goal. The reward helps to reaffirm your savings habit.

Continue to Make Payments Even After Paying Off Debt

Once you have cleared a debt, i.e., credit card debt or car loan, continue to make the same level of payment but to your savings.

Make Same Amount Payments:

If you were making $200 monthly payments on a debt, continue to do this, but make this payment to your savings account.

Savings Build Up Faster:

By doing so, you can build up your savings quickly without having to change your lifestyle.

Apply Successful Budgeting Methods

Budgeting is the key to financial wellness. So long as you are aware of and manage your income and expenditure, you can make smart decisions that work in favor of your financial objectives.

Pay Yourself First:

Save first and treat it like an essential expense by paying yourself first.

Track Your Expenses:

Monitor where you spend your money every month so that you can cut back on areas where you can spend less.

Pay Off High-Interest Debt:

Pay off high-interest debts first to reduce the total interest paid.

Live Within Your Means:

Spend less than you earn by making choices between wants and needs.

Be Wary of Credit Cards:

Spend wisely on credit so as to have a good credit score and not accumulate debt.

The Psychological Benefits of Saving

Aside from the actual financial gains, saving money has excellent psychological benefits:

Less Stress:

Financial security leads to relief and allows you to feel in control of your life.

Better Mental Health:

The ability to save can lead to a positive attitude and overall better health.

Increased Confidence:

Having money set aside in reserve leads to confidence and easier decisions to make.

Conclusion

Using these psychological tricks, you can turn automatic saving into a simple and enjoyable second nature of your lifestyle. Automatic saving, tracking expenses, and living within your means will make you financially stable and enjoy the resulting peace of mind. Remember at all times that financial well-being is a marathon and not a sprint. Take it one step at a time, do it as a daily ritual, and your savings will grow.