Auto insurance is mandatory for each driver, yet it does not have to break the bank. Using the right strategies, it is possible to significantly reduce auto insurance coverage but maintain enough coverage. Understanding how auto insurance policies function and what affects their prices can help you make informed decisions. Some of the best ways to reduce the cost of your car insurance premium are given below.

Understand the Basics: Third-Party vs. Comprehensive Coverage

Before we proceed to cost-saving tips, we need to know the various car insurance policies one can have. The most minimal and compulsory policy is third-party insurance. This ensures damage or injury you may inflict on others in case of an accident but not your vehicle. It is usually the lowest-priced and is a good choice for cost-cutting drivers.

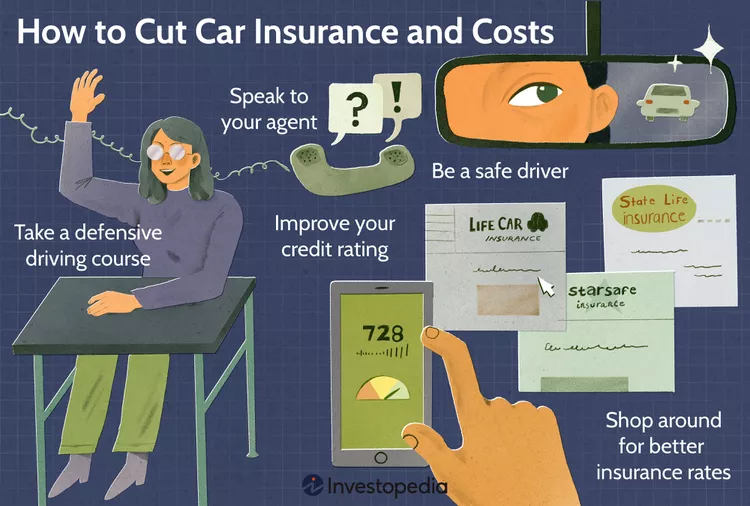

Shop Around and Compare Quotes

Another efficient strategy for reducing car insurance premiums is to compare around. Each company calculates premiums with varying formulas, so prices from one provider to another may widely differ. Employ comparison tools over the web and get quotes from various companies as well as their offers. Look not only at the cost—but also at the limits of the coverage, the deductible, and customer service standing.

Raise Your Deductible

Your deductible is what you contribute upfront before your insurance pays. By choosing a higher deductible, you can lower your monthly premium. But be sure that you choose a deductible that you will be able to afford if there is an accident. This strategy will work best for careful drivers who tend to make fewer claims.

Have a Clean Driving Record

Your driving record is an important factor in determining your rates. A clean record driver, or one without accidents, is considered to be low-risk, without tickets and other crimes, and may qualify for low rates. On the other hand, an accident record or crime history can increase your rates. Drive carefully to ensure a correct record and low rates.

Make Use of Discounts

Insurance providers have a range of discounts that you can benefit from. Some popular discounts are:

- Safe Driver Discounts: For good driving records.

- Multi-Policy Discounts: This is for combining your automobile insurance with other policies such as home or renter’s insurance.

- Good Student Discounts: For students who perform well in their studies.

- Low-Mileage Discounts: For low-mileage drivers who do not use their automobiles often.

- Anti-Theft Device Discounts: For cars that are fitted with anti-theft systems.

Inquire your insurer which discounts are on offer and apply them to those available to you.

Drive a Safe and Affordable Vehicle

Your own car can have a significant impact on your insurance costs. High-demonstrations or luxury vehicles are more expensive to insure as they are expensive to replace and are at greater risk of theft. On the other hand, safe, cheap, and reliable cars are cheap to insure. It is wise to research the insurance cost of a car before purchasing it so that you will be surprised later.

Improve Your Credit Score

In most areas, insurance providers use credit scores to determine the risk. A better credit score is a sign of financial responsibility and can mean less premium. To increase your credit score, pay bills on time, reduce outstanding loans, and check your credit report for impurities.

Consider Usage-Based Insurance

Usage-based insurance (UBI) plans utilize telematics boxes or smartphone applications to monitor your driving behavior, including speed, braking, and miles driven. Careful drivers can receive high discounts from such plans. As a defensive driver, UBI is an excellent means of reducing your premiums.

Reduce Coverage on Older Vehicles

If you own an older car with low market value, it may be wise to lapse comprehensive and collision coverage. The cost of these coverages may exceed the value of the car, so it would not be worth continuing full coverage. Leave liability coverage intact to protect you from damage to other individuals’ property.

Pay Annually Instead of Monthly

Some insurers discount their customers for paying premiums annually or biennially rather than monthly. Though this involves making a larger upfront payment, in the long run, it is a money-saver.

Be a Member of a Car Club or Professional Organization

Some insurers offer discounts to members of certain groups, such as alumni groups, professional organizations, or automobile clubs. Check for any group discount you qualify for based on current affiliations.

Minimize Gaps in Coverage

It is quite crucial to have continuous insurance coverage. Even a short break in coverage can lead your premiums to rise upon reinstatement of coverage. If you are facing financial hardship in paying the premiums, speak with your insurer by calling them to discuss options rather than letting the coverage lapse.

Final Thoughts

Lowering your car insurance premiums is not a matter of giving up coverage. It is a matter of getting to know your policy, doing research, and tapping into discounts. You can subsequently discover low-cost protection that is right for you without having to mortgage the family home. By doing so, you will drive with confidence that you are covered without spending a fortune.