When it comes to running an organization, there are not many more important aspects than that of making smart financial decisions. One area that might make a huge difference in terms of your firm’s finances, the satisfaction of your employees, and operational efficiency is transport. Leasing company cars is quite an attractive option for businesses in need of business cars; options for the same are so much easier on the wallet than buying them out and out.

Leasing can be offered to small businesses with just a few employees and big corporations maintaining fleets. It offers flexibility, tax benefits, and lesser capital expenditure. Throughout this blog, we examine several of the benefits of company car leasing and outline how to decide whether it is right for your business.

Cost Efficiency

image: – investopedia

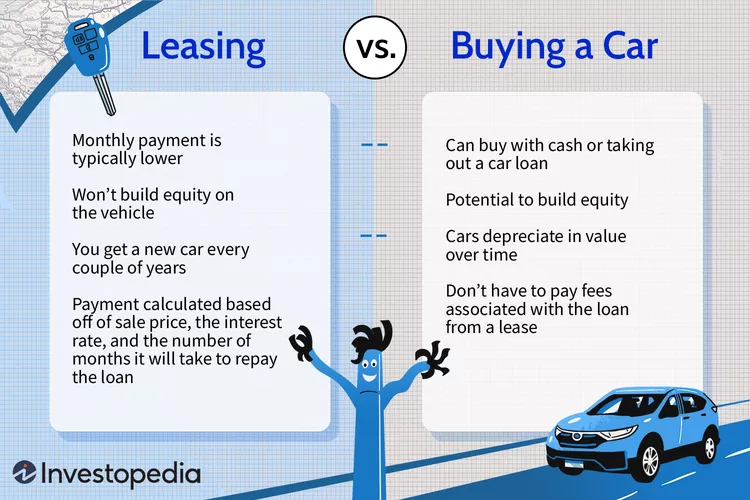

Cost savings are among the most overwhelming reasons why company car leasing is chosen. The actual purchase of a vehicle requires large capital, which could be too difficult for your company’s cash flow. In leasing, however, the monthly payments involved are manageable, hence allowing you to save your capital for use in other operational expenses.

Also, most of the leases would have maintenance and repairs, even insurance in the agreement, meaning fewer blows from unexpected costs over time. This level of predictability will afford better budgeting and financial planning.

Access to Newer Vehicles

Leasing will allow your business to drive new, modern vehicles without the long-term commitment of ownership. Most leases are made for two to four years, allowing you to drive newer models much more frequently. This ensures your team drives models featuring the latest safety features, technology improvements, and fuel efficiency upgrades.

The newer the cars, the lesser the chances of a breakdown, which in turn reduces overall business downtime and enhances productivity. A company with a fleet of reliable, fuel-efficient cars enjoys benefits related to lower operational costs and an enhanced company image when your staff shows up for meetings or events in modern vehicles.

Tax Benefits

Another positive thing about leasing a car for business is the tax benefits that many companies enjoy. If you are using your vehicle for the main purpose of business, then your lease payments may be tax-deductible to lower your overall taxable income. In many regions, both depreciation and interest components can be written off in a lease. You might even avoid certain taxes applicable to vehicle purchases, depending on your local tax laws.

To this end, it is wise to consult with an accountant or a tax professional before entering into a lease to determine exactly what tax benefits may be available in your jurisdiction.

Better Cash Flow

Good cash flow is critical in any business. Leasing cars supports your cash reserve, as you do not need to make a massive down payment the way you would when buying. This saves money that could otherwise be invested in more critical areas of the business, like marketing, hiring, or product development.

Also, since lease payments are spread over the length of a contract, they become fixed operating expenses and are, hence, easier to budget for.

Lowers the Risk of Depreciation

The other major drawback of having a vehicle is that it devalues. Right the minute the car leaves the dealership, its value starts to fall, and with time, it could lose a considerable amount from its original value. This could turn out quite tricky, especially when a business wants to sell the vehicle or even change it after a few years of usage.

The leasing company takes this risk when leasing since you can return the vehicle at the end of the lease term without much concern over resale value.

Flexibility for Business Growth

Business needs often fluctuate, and leasing allows you to adjust your vehicle fleet to meet your growing company. If you hire new workers or expand into more regions, you can easily lease additional vehicles without the long-term financial burden that goes hand-in-hand with buying. On the other hand, if your company downsizes or no longer needs as many vehicles, then at the end of the lease term, it is easier to return leased vehicles and adjust accordingly.

Enhanced Employee Satisfaction

Company cars are sometimes treated as a very lucrative benefit for employees. Leasing gives companies the capacity to provide their staff with high-quality, newer vehicles at a relatively minimal upfront cost. Workers who cover long distances for work or even business persons who need to move from one place to another for meetings or site visits will be satisfied with modern, comfortable means of transport.

Moreover, company cars provided through leasing may be used to attract the best employees. Companies offering cars as part of compensation may show better employee retention and morale.

Company Car Leasing vs. Personal Car Leasing

Company car leasing has several benefits compared to personal car leasing. The most important one is mileage flexibility, which is generally not restricted in the case of company car lease contracts, unlike personal car leasing contracts, where the value is normally preset. Different firms provide different business plans and offers.

While buying, one must look into the contract offers and conditions in detail to ensure that their requirements are fulfilled. One has to enquire about everything in detail and choose only the necessary offers. As a case, say the firms give you an option whether or not to include maintenance services in the contracts.

In this case, it would be wise not to include the above offer in the contracts as the vehicles are new, and maintenance is not a big issue for new wheelers. This freedom from maintaining jobs is also a great relief for firms as the cars are new and under warranty cover.

Leasing vehicles is a great advantage for the company as it does not need to record its depreciation in its account book. Once the lease term is over, the business should not blindly renew it again. Before taking a new lease, many points need to be considered, including experience with contract offers and financial issues.

If satisfied, the company may like to obtain the vehicle fully to become the owner or extend the contract. Before taking a second lease, it is always advisable to look for a new firm and compare their offers with the past one. The lease market is always competitive, and firms change their plans frequently.

Several factors must be considered before making a deal. Although car leasing is not a difficult job, with a good understanding of tax rules, contract offers, and a comparative survey among the different leasing firms, the company can enjoy the maximum benefits out of car leases.

If you have been looking for a car leasing company in the UK, consider Leasing4Business. It is an established company in this niche with client-friendly leasing options and strategies.

Conclusion

Company car leasing offers quite an array of advantages, starting from cost efficiency and tax benefits and ending with increased flexibility and higher employee satisfaction. Leasing is among the best options for businesses that want to maintain a contemporary fleet without taking on the burden of ownership.

If your business plans to expand its fleet of vehicles, leasing could meet your short-term needs and long-term goals.