Financial emergencies pop up unexpectedly. Whether it is an urgent medical bill, home repair, or getting through a particularly tough financial spot, access to instant cash is imperative.

Luckily, auto title loans offer one of the easiest solutions for such situations. Auto title loans are designed exclusively to provide emergency funds without too much hassle. Now, let us explore the benefits and why there is a demand among borrowers lately.

Available for People with Bad Credit

Credit history generally poses big challenges to borrowers regarding loans. In terms of credit, conventional banks and lending institutions have set a criterion requiring them to carry out full credit checks that immediately disqualify borrowers with poor or negative credit scores.

The beauty of auto title loans lies in their accessibility. Lenders usually do not focus on your credit score at all. Instead, the value of your car serves as collateral. As long as you have a clear title and own the vehicle outright or have sufficient equity, you are likely to get approved.

This makes auto title loans a perfect solution for one who needs cash urgently but does not want to go through the stress of a credit examination.

Fast and Agonizing Procedure

Time is a very essential factor whenever dealing with a financial emergency. Though conventional loans can be processed in a couple of days or weeks, it does require tons of paperwork and a myriad of approvals.

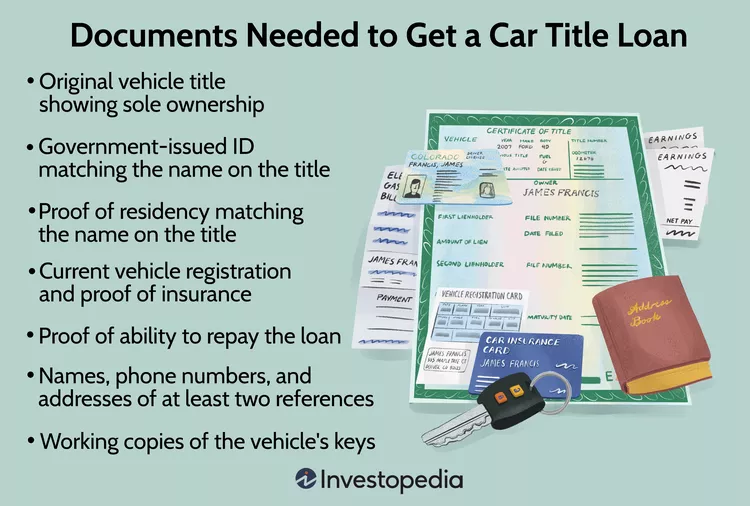

The closer, however, is fast when it comes to auto title loans. Most applications take only 10 to 15 minutes. The borrower simply presents the vehicle title, identification, and proof of ownership. After a very brief inspection of the car’s condition and market value, the funds are released right away.

This rapid process ensures that access to the needed money happens without any more delays on the part of the borrower.

Flexible Loan Amounts

Another advantage of auto title loans is that they provide flexible loan amounts. Most of the traditional lenders have a minimum loan requirement of about $1,000, which may be way more than some borrowers need.

On the other hand, auto title loans can go as low as $100. What is more beneficial from this is the availability of it only when the debtor needs to just cover the required amount, usually for emergencies that include utility bills, minor repairments, etc.

The debtors are free not to be troubled by large amounts borrowed and interest incurred. They will then opt to acquire only what is needed.

No Usage Restrictions

Unlike other loans, which usually come with specified conditions on where the borrowed money needs to be allocated, such as home or college loans, auto title loans do not have such strictures.

As soon as the loan disbursement takes place, borrowers may use the money to settle any pending medical bill, pay the rent, or even cover an unexpected travel cost. This leaves the borrower in complete control over his financial needs rather than the lender’s dictation on how it should be allocated.

Convenient Application Options

In today’s digital world, convenience is everything. Many auto title loan companies allow borrowers to apply online, making the process even more accessible and efficient.

The borrowers can do all this work at home from the comfort of their homes – filling out the form, sending documents to the lending office online, and then driving that car to their office for further inspection.

For some, mobile inspection services also offer the benefit of having the company’s representative come to assess the vehicle at one’s place of residence.

The process allows the borrowers not to waste time standing in long queues and making multiple trips to the office of the lender.

Keeping Your Car

One of the biggest fears related to auto title loans is losing your vehicle. However, if borrowers continue paying on time, then they can carry on with driving their car without any hassle.

After all, lenders are really interested in holding the car title as collateral, not the vehicle itself. This way, a borrower wouldn’t have a problem even with having to keep his routine unchanged.

Important Points Before Applying

Auto title loans carry various benefits, but approaching them with great responsibility is a must. Thus, here are a few key factors that need to be kept in mind:

- Interest Rates: Most auto title loans have more expensive interest rates than most other loan types. Interest rates are pretty high in most auto title loans, but the borrowers should look for the best terms so that they can repay the loan within the stipulated time.

- Loan Terms: Repayment terms are essential, as some lenders allow flexible repayment plans while others have strict repayment terms.

- Risk of Repossession: If the borrower fails to repay the loan, the lender may repossess the vehicle. A borrower should only take a loan if he is sure that he can repay it.

- Reputable Lenders: The lender must be reputable and have transparent terms and fair practices. Reading customer reviews and checking for licensing can help identify trustworthy companies.

Conclusion

Auto title loans come in as practical and accessible loan options for clients who are often in a dilemma of needing money desperately but failing to qualify for typical loans.

Indeed, fast processing, flexible loan amounts, and the lack of credit checks are advantages through which one can be relieved, especially when getting into a dilemma of financial distress.

However, they should be cautious and understand the terms fully to avoid pitfalls. With this, they can make the most of this convenient financial option and address their urgent financial needs without unnecessary stress.