Few years ago, an 8% mortgage on rental property could have sounded like a wonderful deal. However, the kitchen and bathroom in your investment house have seen better days, and rates have plummeted like a rock.

Is it better to sell and start over? Not unless you are prepared to restructure your mortgage.

For a variety of reasons, borrowers refinance mortgages frequently. Given all the expenses involved, you shouldn’t take this lightly, but it is a useful tool for property owners.

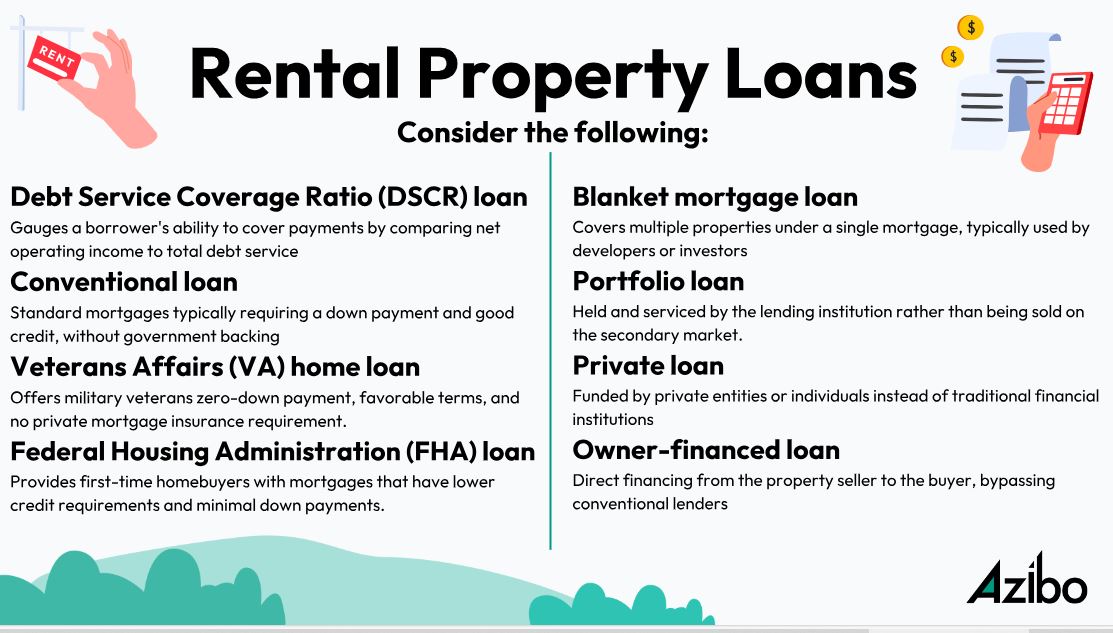

Image Source: Azibo

How to Refinance Rental and Investment Properties

Step 1: Gather Your Documents

You will need to provide some paperwork. Here’s what you might need:

- Basic info: ID, property insurance, current mortgage details.

- Income proof: Usually, there are tax returns or pay stubs, but some lenders don’t need this for rental properties.

- Financial snapshot: Bank statements, investment accounts, and business records (if applicable).

- Rental details: Lease agreement, property registration (if needed), business paperwork (if applicable).

Keep in mind that the prerequisites differ according to the kind of lender. If you contact a traditional mortgage lender, they will likely need further documentation; these lenders often write mortgages for homeowners. Additionally, anticipate a lengthier procedure.

Less paperwork is needed from portfolio lenders, who hold the loans on their books and frequently function as hard money lenders. These lenders typically don’t need proof of income. Rather, they examine the rent you get and project your future cash flow using a metric known as the Debt-Service Coverage Ratio (DSCR).

The lender divides rent by principle, interest, taxes, insurance, and association dues (PITIA) each month to determine the debt-service coverage ratio (DSCR). They generally view a DSCR greater than 1.2 as solid. Portfolio lenders use this measure instead of debt-to-income ratios (DTI).

Step 2: Apply

Make comparisons between interest rates, points, and flat “junk” costs by contacting many lenders.

Remember that only a maximum of four mortgages are permitted to report on your credit history under most conventional mortgage financing programs. That means you can only utilize them for the first few homes you own.

Portfolio lenders usually do not apply these limitations and do not submit any kind of credit bureau report. They frequently reduce their prices for more seasoned real estate buyers.

Even though portfolio lenders sometimes don’t need proof of income, they run a credit record on you. Before applying, check your credit report and obtain verbal quotations while comparing prices. Permit the lender of your last option to get your credit report only.

Step 3: Fix Your Interest Rate

After selecting a lender, lock in your interest rate and submit your complete application with all supporting paperwork. After that, you will receive a Good Faith Estimate—a formal confirmation of the loan pricing—from the lender.

Your loan estimate is generally valid for 30 days from settlement. Don’t provide any justifications for keeping your loan after that thirty days. Whenever they ask for further documentation, always reply right away.

Step 4: Go Through Underwriting

Your loan officer will usually order an appraisal once you return them the completed loan application and all of the basic documentation they requested. A processor receives your loan file, arranges it, and marks any missing information so the loan officer may inquire about it.

The appraisal and all supporting paperwork are sent to underwriting for risk evaluation once it is in your file. The underwriters verify that the lender can take the risk associated with your loan. Anticipate them to scrutinize the property evaluation closely and request more paperwork as the procedure progresses.

If the loan officer approves the loan for settlement based on their comfort level with the loan’s risk profile, they will contact you to arrange a closing date.

Step 5: Complete the New Loan Closure

You have witnessed settlements as a real estate investor and know how your hand becomes tense after signing 100 signatures.

A final settlement statement should be requested the day before closing. Pay close attention to every line, especially the fees. Are they in line with the first Good Faith Estimate you received from the lender? What has changed, if not? Any differences should be explicitly stated in the revised text.

Additionally, confirm that the title company did not seize funds for previously paid water or property taxes.

Reasons to Refinance Your Rental Home

We generally advise against refinancing properties for investors. It stretches your loan horizon into the future, begins your amortization schedule at Square 1, and incurs thousands of dollars in closing charges.

Refinancing a rental property is still a smart move in several situations. The most frequent explanations for landlords’ refinancing are listed below.

Reduce the interest rate on your mortgage

You could refinance at a significantly cheaper rate if you had a mortgage when interest rates were considerably higher than now or when you had poor credit. As a result, you can increase your monthly income flow or, at the very least, break even after taking cash out of the property.

Determine when it would take you to recoup your interest savings and the money you paid for closing fees. Even better, total up all closing expenses and the interest paid throughout the life of the loan for the mortgage refinancing. Compare that amount to the interest still owed on your existing mortgage. If you do an apples-to-apples comparison, you could discover that the remaining interest on your current mortgage will be less than the total cost of interest and fees associated with refinancing.

Modify the Loan’s Term

The cash flow of your investment property may not be as good as you had hoped if you originally purchased it with a 15-year mortgage. Most non-landlords are unaware of the numerous expenditures that landlords face, including upkeep, repairs, vacancy rates, and property management fees.

Therefore, to raise their yearly cash flow above water and cease losing money yearly, several landlords refinance their 15-year loans to a 30-year fixed mortgage.

Don’t refinance to a 15-year mortgage if you purchased your home with a 30-year mortgage and want to pay it off sooner. Simply increase the principal amount of your current loan each month. These additional strategies can also be used to pay off your mortgage early.

Change an ARM’s interest rate to a fixed one

Lenders of mortgages favor lending adjustable-rate mortgages (ARMs) over fixed-interest loans. It incentivizes borrowers to refinance while providing them with enhanced protection against potential fluctuations in interest rates.

Consider refinancing to a fixed-interest mortgage if you purchased the home with an ARM, and the initial fixed interest rate is set to change to an adjustable one. Your new rate will probably be greater than the previous one unless rates have dropped dramatically since you purchased the home.

Pay Back Investors

You will probably have a shorter payback time than if you had borrowed from a bank or taken out a loan to cover your down payment from friends, family, or other private investors. You may need to refinance the property to repay them when the time comes.

By giving these private investors your whole monthly cash flow before the loan is due, you may prevent this. You may repay them in full without paying thousands for refinancing if you work hard and get lucky.

Conclusion

Equity is something that investors frequently seek to take out of their homes and use for other ventures.

They often withdraw equity to use as a down payment on a new investment property. As a result, they are able to maintain increasing their monthly cash flow and real estate holdings.

However, property owners can also use equity to pay for upgrades at another investment property or at the property that is being refinanced. They might also use it for equities, real estate crowdfunding, or real estate syndications, among other investment options.

Remember that home hacking allows you to employ primary residence finance as you look into innovative financing possibilities for investment properties. However, remember there is still a mortgage restriction, so you can likely only do this with up to four houses. Following that, you would have to fund your rent through mortgages on investment properties.