Life insurance is the most popular among all insurance types. Unless you are a multi-millionaire or the heir of a business magnet, you need to be covered. Life insurance is considered useful for death benefits, which are tax-free to those, whom it passes on.

Term life vs whole life

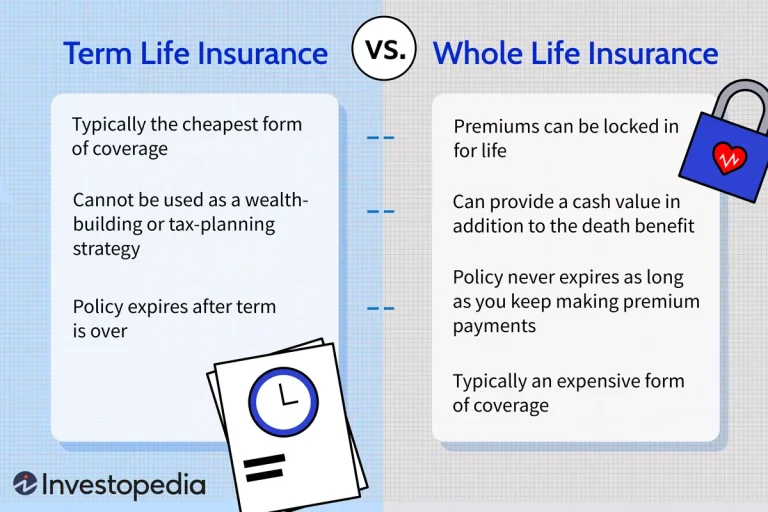

The dilemma faced by many is they can’t decide whether to choose a whole life insurance or a term-life insurance. In the past, people preferred to buy whole life insurance because they wanted the policy to secure their family’s income in their absence. Very few happened to buy term insurance policies back then.

Which one to choose?

But now, things have changed. Many seem to prefer term-life policies over whole life policies. Which one should you pick? Term life or whole life? There’s no easy and one-line answer. I discuss both types here so you could decide on your own.

Whole life insurance

It’s the commonest type of life insurance. By life insurance, the majority of people understand whole life insurance. The wealth keeps accumulating in the consumer’s savings account tax-free with dividends and interest. Meanwhile, the consumer pays the monthly premiums.

It’s benefits

The very first benefit of a whole life policy is piles of cash keep stacking up in your account, without you having to pay tax. Consumers don’t pay tax on annual gains either, and they can use the rest of the money (after paying premiums) for retirement planning.

Whole life insurance policies are designed to ensure the investment and the mortality rate both grow at the same pace. The structure of a whole life policy is consumer friendly because the investment portion of the policy grows while the death benefit amount stay unaffected. The face amount upon the death of the insured is paid to his beneficiaries. The face amount can also be paid in the case of the insured reaching 100 years of age.

The disadvantages

Alongside the benefits, there are some disadvantages of whole life insurance. Whole life policies are more expensive, not so flexible and come with low interest rates. The larger the policy, the more is the premium amount. The premiums are high for yet another reason. The premiums are used to cover the accumulation of the cash value.

The interest rates for whole life policies are significantly low. In fact, it’s one of the reasons that after the introduction of the Tax Equity and Fiscal Responsibility Act (TEFRA) in 1981, the popularity of whole life insurance dropped as banks started to offer 10%-12% interest on other investments.

Term life insurance

Term life insurance has everything similar to whole life insurance. The difference between the two is whole life insurance is for the entire lifetime. The policy protects the customer for a certain period of time. In case of his death during that time, his heirs receive the promised sum. But if he stays alive when the policy expires, he loses the premium.

Contract type

The contract period can be of 1 year, 5 years, 10 years or 20 years. Mostly, if the contract period is more than of 1 year, the individual mortality rate is added for each single year. When the average monthly premium is calculated, the annual mortality rate is considered.

Term insurance benefits

Term insurance is less expensive. If you are looking for maximum coverage, at a low premium rate, and for a certain period of time, then go with a term insurance. Parents, who are not sure whether they’d live for another 20 years, and are worried about the future of their children, go with term life insurance.

If you are 30 years old, healthy and you make $50K a year. If your earning increases at a rate of 10% each year, at the time of retirement, you’d be making a sufficient amount of money. But in the case of your sudden demise, your family members would lose all that money. Only term insurance can take care of them.

Term insurance disadvantages

What if you are alive after the contract period? Or even worse, what if you die after a year from the expiry of the contract period? In both cases, you lose the money that you’ve been paying for this whole time as premium.

In case of the latter scenario, your family doesn’t receive anything even because the term period contract is over. These are the disadvantages.

Understand your need

It’s wise for you to first understand what you need, and then select a policy. If you only need to be covered for a certain period of time, then term life is best for you. Otherwise, go with the whole life insurance.