In today’s difficult economic environment, many consumers are looking for ways to reduce their spending and save more. Among all the options that can bring considerable savings is car insurance. However, choosing a policy solely based on its low price may be the costliest mistake.

It is essential to balance affordability with adequate coverage in order to be protected when it matters most. Fortunately, by using the right strategies, one can save money and still get adequate coverage. Here is how.

Maintain Auto Insurance Coverage

Dropping your car insurance may seem like an easy way to save money, but it is a very risky move with serious consequences. Most states, including California, legally require drivers to carry at least liability insurance. Driving without insurance can lead to hefty fines, penalties, and even the suspension of your driver’s license.

You should scale down your existing policy if you cannot afford increased premiums. Ask whether you can kick up your deductible or make other non-essential add-on cuts that do not leave you losing the most essential protections. Continuous coverage also helps you avoid potential rate jumps when you ever need insurance again.

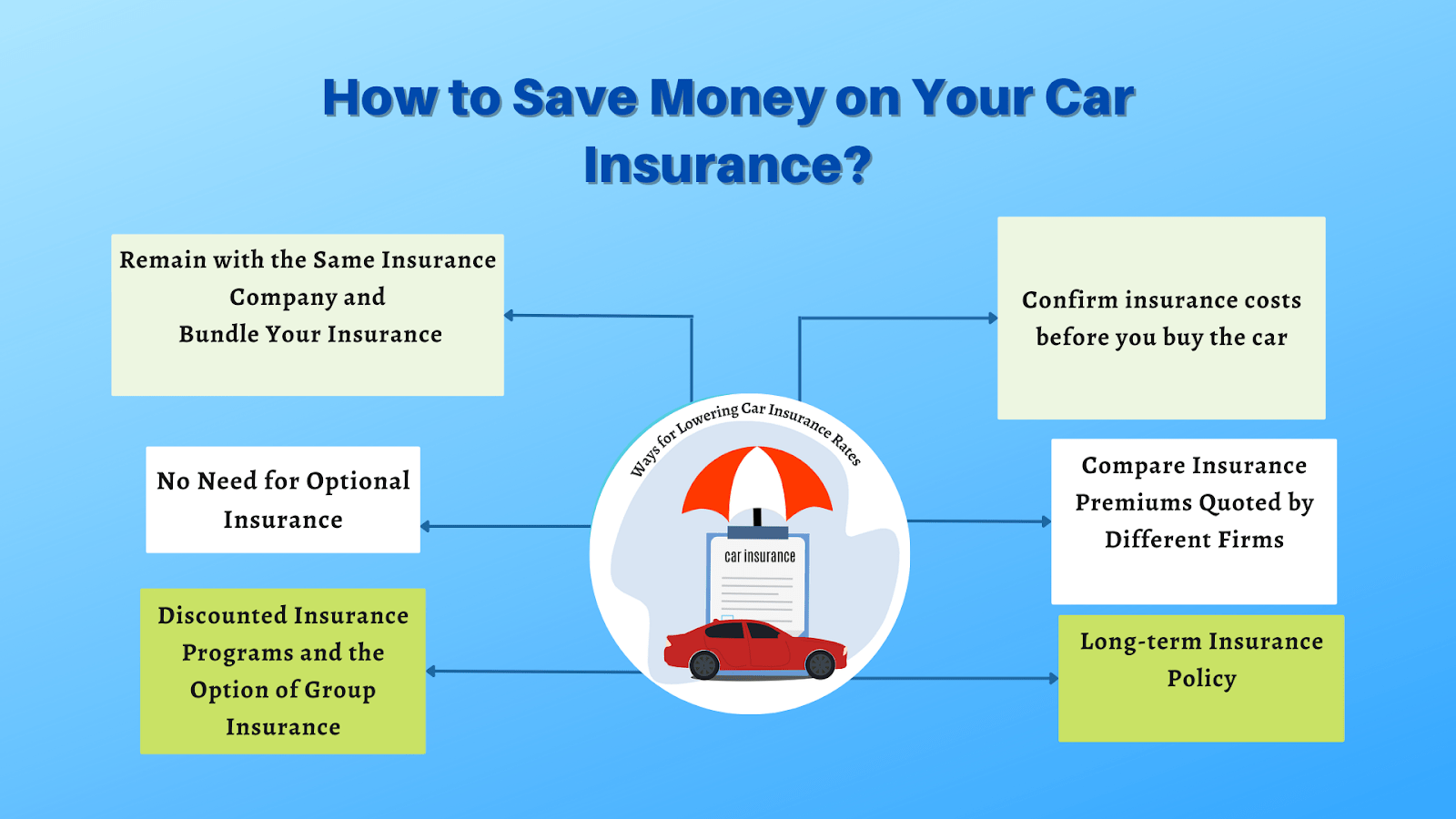

Obtain Quote Comparisons from Various Insurance Companies

Different companies charge different rates, so it makes sense to get quotes from a few providers.

How to Compare Prices

- Shop on free comparison websites for immediate quotes.

- Contact an insurance company directly and ask for a customized quote.

- Compare each policy line by line, including the coverage options, exclusions, and deductibles.

Once you get a few quotes, then sit down and read the fine print. You might find a policy at a rock-bottom price that will leave you exposed when the accident happens. It is better to have the best value rather than a low price.

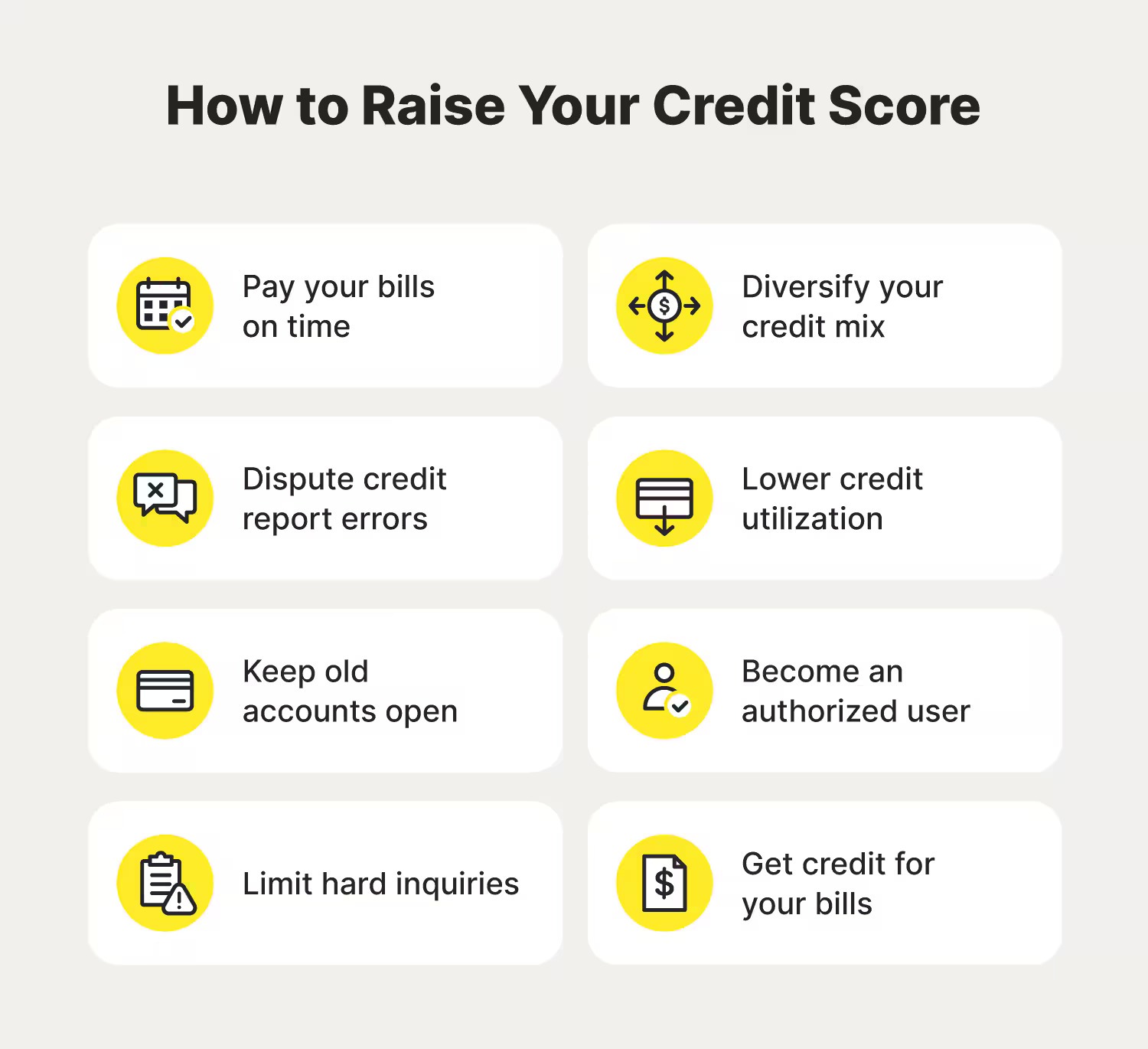

Monitor Your Credit Score

Most car owners do not know that their credit score influences their auto insurance premiums. Usually, an insurer uses the information obtained from credit scoring to rate an individual’s risk. Generally, people with a higher credit score receive low premiums.

Tips to Improve and Maintain a Good Credit Score:

- Pay your bills on time.

- Keep credit card balances low.

- Regularly check your credit report for errors and dispute inaccuracies.

- Improving your credit score may reduce the insurance cost over time.

Select a Low-Risk Vehicle

Many insurance companies believe that what your car makes is highly important in their calculations when computing your premium insurance. Usually, those dearest to replace are the most theft-prone, or those are speedsters that are also usually costlier insurance-wise.

Influencers when selecting a vehicle:

- Safety Features: Cars with advanced safety features often qualify for discounts.

- Repair Costs: Look for models with affordable repair and maintenance costs.

- Vehicle Type: Sedans and family-friendly cars typically have lower insurance rates than sports cars.

If you are in the market for a new car, consult with your insurance provider to understand how different models will affect your premium.

Limit Your Mileage

The number of miles you drive is usually a factor insurance companies use when determining your premium. The more miles you drive, the higher your likelihood of an accident.

Ways to Reduce Mileage:

- Carpool or use public transportation when available.

- Combine errands to reduce trips.

- Consider working from home if possible.

- Some insurers offer low-mileage discounts; be sure to ask for available incentives.

Check for Discounts

Many insurance companies offer various kinds of discounts that will save you money. Some of these discounts include:

- Good Driver Discounts: These are discounts for clean record drivers.

- Multi-Policy Discounts: Bundling auto and home insurance.

- Low Mileage Discounts: Drivers who travel fewer miles every year.

- Safety Feature Discounts: These are for vehicles that have anti-theft systems and more advanced safety features.

Ask your insurance provider about all the available discounts and how you can qualify for them.

Raise Your Deductible

The most obvious way to reduce your premium is to increase your deductible. Make sure you can afford the higher out-of-pocket cost when you file a claim.

Example

If you currently have a $500 deductible, raising it to $1,000 could significantly reduce your premium. Just make sure you save enough to cover the higher deductible when you need it.

Review Your Policy Annually

Life circumstances change, and the case of your car insurance may be the same. Annual reviews ensure you need the current level of coverage, take advantage of new discounts, and compare rates for the best option for you.

Conclusion

Getting the best car insurance is not a bad thing, and it certainly does not need to be a choice between coverage and a lower price. By following some smart strategies, comparing quotes, monitoring your credit, and choosing a low-risk vehicle, you can drive protected while still keeping more of your money. Spend some time finding the right car insurance and other products that really are in your best interests and budget.