Financial management is a critical part of family planning. Only tiny savings contribute to the biggest collections. But not many people these days, in their lives running at a hasty pace, can manage even these little savings from their monthly expenses.

It is really important to be cognizant of the importance of saving money bit by bit, and so is being careful about it. Only these extra savings prove to be the best friends in unwanted and unexpected situations, urgency, and emergencies. Also, these savings help in the future and in times when you do not have a source of income.

Let us check out some ways that may help you save a considerable amount every month:

Why Save?

Let us underscore first why saving is important in the first place. Financial experts harp on the need for savings for a variety of reasons, including:

Emergency Fund: Life is not without its contingencies, and so an emergency fund acts like a financial pillow in times of adjudged eventualities such as medical expenses, fixing one’s car, or even in cases of losing one’s job. A study by the Federal Reserve showed that 63% of Americans cannot cover a $400 emergency without borrowing money or selling assets.

Retirement: The more you delay saving retirement money, the less time that money has to grow. According to a study by the National Institute on Retirement Security, 66 percent of millennials have nothing saved for retirement. Planning for the future helps you maintain your standard of living when you are no longer working.

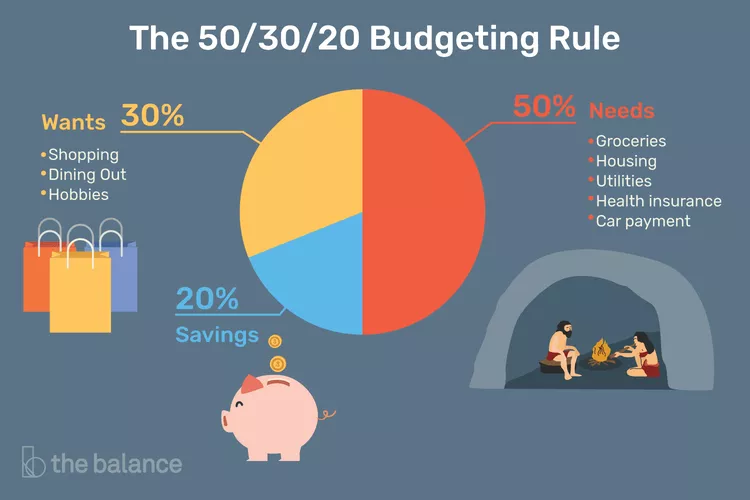

The 50/30/20 Rule: A Simple Starting Point

Image: thebalancemoney

One of the most straightforward yet popular rules for saving is the 50/30/20 Rule. Created by U.S. Senator Elizabeth Warren, the plan involves dividing a person’s after-tax income into three general categories:

50% Needs: Things like rent, groceries, utilities, and transportation.

30% Wants: Things such as entertainment, dining out, travel, and hobbies.

20% Savings: This would include your emergency fund, retirement contribution, and any debt repayment.

Let us break this down with an example. Say you take home $3,500 per month:

- $1,750 (50%) is dedicated to needs.

- $1,050 (30%) is dedicated to wants.

- $700 (20%) goes into savings.

How Much to Allocate for Various Goals?

-

Emergency Fund

Financial experts suggest putting aside three to six months of living costs. This fund is your cushion for those ‘just in case’ circumstances. The best method to calculate how much you will want to save is by estimating your total monthly expenses—photo estimate, insurance, and any other essentials—and multiplying by three or six.

One should be in a position to have from $7,500 up to $15,000 set aside in an emergency fund. If you start at zero, then set a smaller goal-for instance, save $1,000 within the first six months. The important thing is consistency.

-

Retirement

Most experts recommend 15% of gross income in retirement savings. This percentage ensures you are putting away enough to comfortably retire while you are getting started early. If your employer offers a match, such as offering a 401(k) in the United States, take it because it is free money.

Age 30: Fidelity says you should aim to save the equivalent of your annual salary three times your salary by age 40 and six times your salary by age 50.

-

Short-Term Goals

If you are saving for shorter-term goals, such as a vacation or a down payment on a car, calculate how much you need and how long you have. For example, if you are going on a trip costing $3,000 in a year, you will need to save $250 a month.

Shifting Your Savings Rate

Image: Savology

The amount to be saved every month is not the same for all. As a matter of fact, your savings rate can change, given your circumstances. Let us consider a few factors that may specify how much you really should save:

Income Level: Higher-income earners may be able to devote more to savings, while lower-income individuals might be restricted by necessities first.

Debt: If you have high-interest debt, such as credit card debt, focus on paying that off before ramping up savings. Carrying a balance on a credit card at a 20% interest rate can actually erode your financial progress.

Aims/goals: The savings rate should be aligned with your financial goals. If you are saving for a house down payment or another expensive purchase, you might save more aggressively for a period and then revert to a balanced savings rate.

Age: The younger one is, the more time one has to get a head start on saving for retirement. Therefore, young people can often afford to save a smaller percentage in the near term. Older individuals may need to save more aggressively to catch up.

Easy Tips to Save Money Every Month

Let us check out some ways that may help you save a considerable amount every month:

1. Keep track of your monthly expenses:

Keep all your bills and receipts saved & collected for one month at a place. Now, make a spreadsheet categorizing your expenses on different things like food, rent, monthly debt payments, entertainment, pets, utilities, etc. Match these expenses with your salary and see which category is overbrimming.

Cut off expenses on that part. Suppose it is food. Decide your monthly budget for food according to your salary. Save a certain amount in every category, and you will realize that you are able to save quite a considerable amount at the end of the month. You can also use online home accounting software for this purpose.

2. Seek discounts on insurance policies:

Different insurance companies offer a plethora of policies along with different beneficial offers and schemes. Keeping track of all of them is a little difficult, but an insurance agent can help you find ways to incorporate several discounts on your policies and entertain them.

Your insurance agents can avail you of some special discounts applicable to some conditions. For example, for an accident-free driver, many insurance companies give price breaks on auto insurance.

3. Prefer raw foods over packed & processed ones:

Foods that have undergone processing and quality control and are sold under a brand name are likely to be more expensive in the market. However, you can buy raw and fresh foods and cook them yourself at home.

They will be as healthy as processed foods and also help you save the money that you would have spent on packaging and processing food for that company.

4. Use electricity smartly:

It is a common habit at home that we never directly cut the power while switching off the television; we just leave it on standby mode and get away. Even on standby mode, the television continues to consume electricity.

So make sure that the next time you have to go somewhere between watching your favorite TV serial, you cut the power from the main plug. The same applies to other appliances as well. Do not leave lights and fans turned on when you don not need them. It will certainly save you a good amount on electricity bills.

When you have a home and a family to look after, you must start learning the difference between your needs and your desires. Spend where required. Save money for a brighter future.

Automate Your Savings

One of the best ways to ensure that you are not lagging behind in saving is by automating the process. Most banks have the facility to directly transfer money from your checking account into your savings or retirement account. Automatically saving will make it quite painless, and you can not use that money to spend somewhere else.

According to the Consumer Financial Protection Bureau, people who employ automated savings methods have a 25% chance of saving regularly compared to those who save manually.

Final Thoughts

So, how much should you try to save per month? It all depends on your financial goals, income, and spending habits. However, starting with the 20% rule and adjusting it according to your individual circumstances is a perfect way to instill a saving habit.

Remember, every dollar saved is the way to financial freedom. Start small, be consistent, and over time, your savings will build up, giving you peace of mind and allowing you to live life on your terms.