Unsecured loans are a type of loan that is not secured against property, vehicles, or savings. Because of this, they are highly in demand among people in need of quick finance. On the other side, a lack of collateral often means high interest rates. Thus, it may be difficult to find an unsecured loan that can fit your affordability. Everything depends on how to work out the lending process and how to get an unsecured loan with considerable benefits.

In this article, we are going to spell out some strategies that can help you get unsecured loans faster and make more informed decisions about your finances.

#1. Understand Unsecured Loans

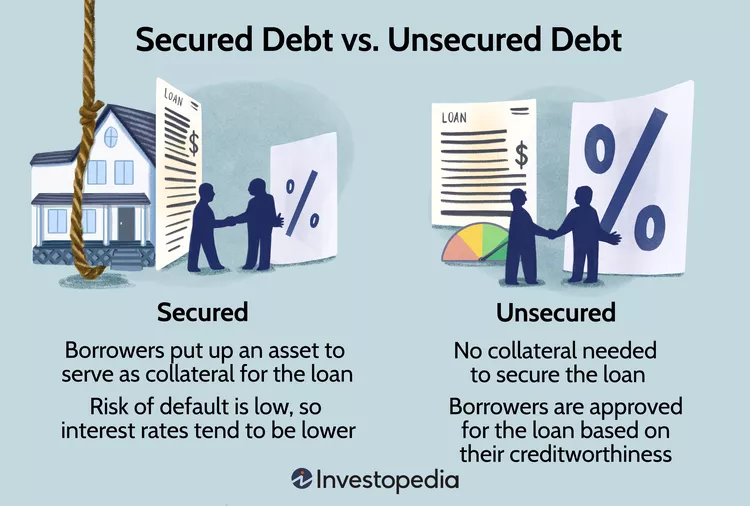

Image Source: Investopedia

Before discussing the application strategies, it is vital to understand what unsecured loans imply. An unsecured loan is one in which the borrowing party is not obligated to present any form of asset as securities. In return, the lender grants a loan based on credit history, income, and general financial health. The common types of unsecured loans include personal loans, student loans, credit cards, and some forms of business loans.

#2. Check and Improve Your Credit Score

A good credit score is one of the most important factors that every lender looks for before issuing an unsecured loan. In general, a good credit score shows you are a responsible borrower, paying your debts on time; a low score reflects risk, which may lead the lender either to not issue the loan or to charge a much higher interest rate.

If you want to get an inexpensive, unsecured loan, you will want to keep your credit score above 700. Here are some tips to help you raise your credit score:

On-time bill payments: On-time bill payments make up a big part of your credit score, so it is never ok to miss or make a payment late.

Decrease outstanding debt: Reducing the overall amount owed will positively contribute to improving your credit score. Keep your credit utilization ratio below 30%.

Avoid new credit inquiries: Loan or credit card applications made repeatedly tend to reduce the score. If you plan to apply for unsecured loans, avoid making applications for new credit cards or other loans at the same time.

Monitor your credit report: Your credit report should always be in order. Go through it to clear any discrepancies that might lower your score.

Enhancing your credit score before applying for a loan can improve your chances of securing lower interest rates and faster approval.

#3. Compare Loan Options

Not all lenders are the same when it comes to unsecured loans. Some specialize in shorter-term, smaller loans, whereas others may be able to grant larger amounts with longer repayment periods. Comparing several related options is one sure way to get access to more affordable unsecured loans more quickly.

This comparison should first be made between quotes provided by:

Traditional Banks: Banks can have fairly decent rates, but often, their requirements are much harsher, with a longer approval period.

Credit Unions: Many credit unions offer less expensive loans than banks do.

Online Lenders: Online lenders very often have a specialty in quick, unsecured lending. They may not require that you have a lengthy credit history in order to qualify, and their requirements for approval may be a little easier. However, sometimes they charge higher interest rates, so pay special attention to the fine print.

Comparison websites allow you to view multiple loans side by side. Pay extra attention to the following:

Interest Rates: Use the lowest rate possible that suits your financial condition.

Loan Terms: Consider the period of time taken for loan repayment and if it includes prepayment penalties.

Fees: Origination fees, late payment fees, and processing fees are very expensive overall. Comparing a few offers may help you find the finest unsecured loan for your needs and budget.

#4. Apply for Prequalification

More than one lender can even prequalify you simultaneously to speed up the process of loan disbursement. Prequalification lets you know what loan you qualify for without affecting your credit score. The lenders will perform a “soft” check on your credit history to determine whether you are qualified and how much they may lend you.

Prequalification’s advantage is that you can see with which lender your application is more likely to be approved and under what terms. In case, during prequalification, you find a decent offer, then you may proceed to the formal application with an assurance of a higher likelihood of approval.

#5. Opt for Lenders Granting Same-Day or Fast Approval

Some lenders specialize in unsecured loans with quick approval and disbursal. Online lenders, for instance, can provide same-day or next-day approval and funding, presuming you meet their requirements.

Most of these lenders make use of automated systems to review loan applications; hence, the fast processing. You need to ensure you have all your documents ready and should satisfy the minimum eligibility criteria of the lender to be qualified. Remember that same-day loan approval deals that sound too good to be true can probably charge higher-than-usual rates or fees, so make sure you are really getting a good deal before signing up.

#6. Review Loan Terms Carefully

Image Source: Self

This is something you should pay extra attention to, even when in a rush. What looks like an affordable loan quickly becomes financial slavery once the hidden fees, variable interest rates, or unfavorable repayment terms kick in.

Pay extra attention to:

Annual Percentage Rate (APR): This encompasses the true cost of the loan, both in interest and fees.

Repayment Schedule: Let the loan term accommodate your schedule for repayment on time.

Prepayment Penalties and Late Fees: Prepayment penalties abound for some, while others have late fees.

Variable versus Fixed Interest Rates: Fixed rates are invariable; variable rates can change and may result in higher payments in the future.

Conclusion

In other words, accessing affordable unsecured loans much quicker is a result of preparation, research, and making informed choices. Knowing what affects loan approval, improving your credit score, comparing a number of lenders, and carefully considering the terms of the loan ensure financial support without getting into the clutches of debt. Take time to reflect on the best loan option for your unique financial situation; you will be well on the way to accomplishing your goals.