While we make plans and dream of possibilities, life can take unexpected turns. Emergencies like illnesses, accidents, or even the loss of a loved one can strike suddenly, leaving us scrambling to cope. This is where insurance becomes a crucial safeguard.

Having a financial safety net in place, you can protect your family from unexpected costs. Insurance provides peace of mind, knowing that you will have the resources to recover and move forward no matter what life throws your way.

Let us examine insurance in more detail, including what it is, its many advantages, and the various kinds that are out there.

What Is Insurance?

An insurance policy is a legal agreement between a policyholder and an insurance company that provides the policyholder with financial protection or reimbursement against losses. The company combines its clients’ risks to reduce the insured’s payment costs. Most people have some insurance, whether for their life, house, automobile, or health.

Insurance policies protect against monetary losses brought on by mishaps, injuries, or property damage. Insurance also contributes to the financial burden of bearing legal responsibility for harm or damage done to a third party.

The idea of insurance is fundamental, to put it simply. You must buy insurance if you own something important that you cannot afford to replace if it is lost or destroyed. Purchasing insurance assures you that the insurance provider will lessen your losses without affecting your pocketbook in an unforeseen circumstance.

How Do Insurance Policies Function?

Insurance is one of the best ways to protect your family and yourself from a financial loss that may wipe out your life savings. For the insurance policy to function, the insured and the insurer enter into a formal contract.

This insurance policy outlines the numerous terms and circumstances under which the insurance firm is required to offer coverage to the policyholder or their beneficiaries. As such, in the event of an early death or other occurrence, the insured or beneficiary may make a claim with the insurance company. The insurance company pays out the claim based on its final approval.

As previously said, for the policyholder to receive insurance coverage, a predetermined premium must be paid regularly. The lower the premium, the higher the sum assured.

Since extremely few insured people claim, the insurance provider offers high insurance against a negligible premium. Insurance companies accept this risk to provide you with a high level of coverage at a low cost. In addition, the insurance provider has a large clientele that pays premiums. Note that not all policyholders experience loss at the same time.

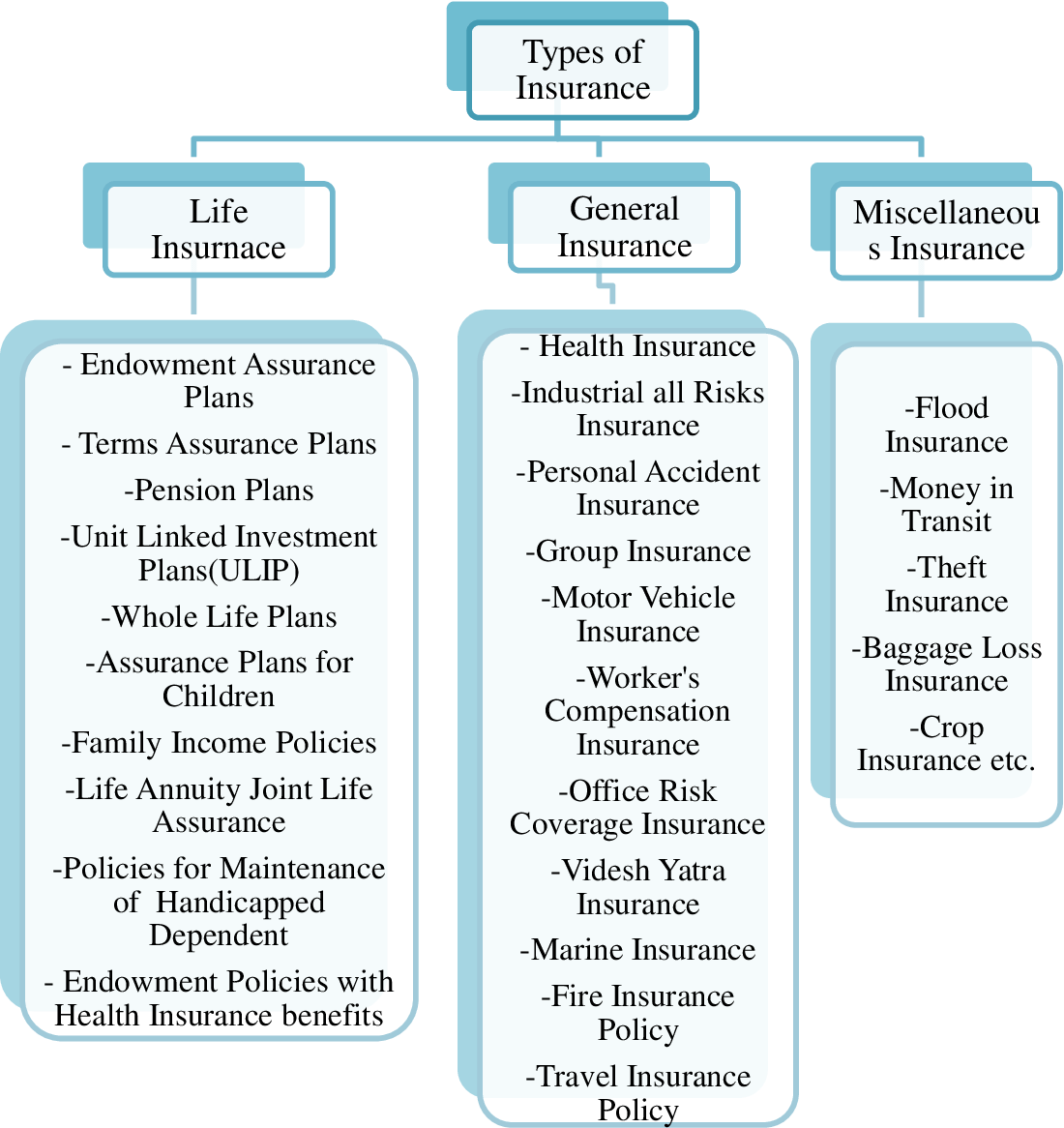

Insurance Types

There are numerous varieties of insurance. Let’s examine the most significant.

1. Health Insurance : Health insurance covers routine and emergency medical costs; additional dental and vision treatment costs apply. In addition, when you have met your annual deductible, you might have to pay copays and coinsurance, which are one-time costs or a fraction of a covered medical benefit.

2. Travel Insurance :mong other costs and losses associated with travel, travel insurance covers emergency medical costs, evacuations and injuries, misplaced or damaged luggage, rental automobiles, and vacation homes. edf

3. Home Insurance : Homeowners insurance, also called house insurance, guards your house, other buildings on the land, and personal belongings from theft, vandalism, and unanticipated damage. Homeowner’s insurance does not cover earthquakes and floods; you must obtain supplemental protection. Policy providers typically give features that can lower deductible amounts and riders that can increase coverage for particular properties or occurrences.

4. Auto Insurance :Auto insurance can assist with paying claims for injuries or property damage to other people in the event of an automobile accident. It can also cover the expense of replacing the car if it is vandalized, stolen, or harmed by a natural disaster, as well as any necessary repairs.

Instead of paying out-of-pocket for motor accidents and damage, they pay an auto insurance company yearly fees. The company then pays all or the majority of the costs associated with an auto accident or other damage to the car.

5. Life Insurance : With a life insurance policy, you can be confident that your spouse or children will get a specific amount from the insurer in the event of your death. In exchange, you pay premiums for this for your life.

Two primary categories of life insurance exist. Term life insurance covers a specified time frame, such as ten or twenty years. Your beneficiaries get paid if you pass away during that time. As long as you keep up with your premium payments, permanent life insurance will cover you for the rest of your life.

Is Getting Insurance Beneficial?

Because permanent or variable life insurance can accrue cash value or be converted into cash, it may be regarded as a financial asset depending on the policy type and usage. In other words, most permanent life insurance plans have the potential to increase in value over time.

Filing Insurance Claims

Most of the unpleasant experiences of consumers when it comes to their insurance policies are in the claiming process. Even some of the biggest names in the industry will find ways to avoid paying out their assured. Here are some tips to lessen your ordeal and increase approval of your claim/s.

Everything You Need to Know

Take time to familiarize yourself with the general rules in claiming, and the terms and conditions you have entered into a policy agreement with your insurance provider. For instance, with auto or home insurances, the claiming process involves the following: informing your insurer or agent of your request, fill in the necessary information on the prescribed form, wait for the representative of your insurer or their adjuster to assess the liability to determine the amount of pay-out. If everything goes well, all you need is simply to wait for the pay-out check.

All Necessary Documents

Do not wait for your insurer to tell you what documents you need to submit to process the request for pay-out. Have them ready early. Insurance companies love documents, and most times they use this love for documents as their reason to deny your request.

From the time of the accident or loss, make sure that you keep everything documented. Present all your documentation on the incident to your insurer whether they ask for the same or not. This will not only hasten claim processing, but will also show your insurer that you mean business and you are taking your responsibility as their assured seriously.

Only Necessary Claim

File only claim/s that are really necessary. Avoid making small claims now and then as your insurer can use this to increase your premium rate upon renewal, or to cancel or deny your policy. You see, insurance is business, and if your insurer keeps on paying, they will see you more as a liability that cuts their profitability. Be prudent in filing your claims.

Check whether it is wise for you to raise your deductible. This is the amount that you will shoulder on your own and deducted from the amount that your insurer has to pay during the claim process. Raising the amount of your deductible is sending signal to your insurer that you are more careful in avoiding incidents that will lead to filing your claim.

File Your Claim Promptly

It is best that immediately after the accident or loss; you file your claim including all necessary documents you already have. You will realize the most insurance providers have their time frame to follow in accepting your claim application. After a certain period, they will no longer honor your application. It is always best to file promptly. Check the terms and conditions of your policy for this purpose.

In summary, when filing a claim, you need to know and understand the terms and condition of your policy, file the claim on time or immediately after the incident, and submit all essential documents for speedy processing and payout. Lastly, make sure that you are current with your premium payment, as this may affect validity of your policy.

What is an Insurance Advisor?

Lots of people make false assumptions about insurance agents; most of the time, they consider them unneeded middlemen. These people hop online and see a bunch of cheap insurance rates; they mistakenly figure that an inexpensive policy will cover them if anything happens. Oftentimes, when these people are involved in an accident, they end up shocked by how unresponsive the insurance company is; without an agent, it’s almost impossible to get a reasonable response from an insurance provider.

Insurance agents help you navigate the complicated insurance world. If you are considering a new policy, an insurance agent can help you in the following ways:

Low Costs : Contrary to what many people believe, you can’t always get the lowest insurance rates online. Online sites quote you low rates in the beginning to suck you in; after you sign up with them, they raise the costs on you. When you work with an agent, you get a real quote; they don’t finagle the numbers to try to entice you.

Insurance agents are aware of what’s happening in the community; an insurance agent in Philadelphia knows the area they work in better than any online site. Because of this, insurance agents get special prices directly from the insurance company. They get these lower rates because the insurance company knows that they will put the consumer into a policy that suits them; this lowers the risks for the insurance company. Low risk means that it costs them less in the long-run.

Easy To Buy Insurance : It’s a lot easier to buy insurance when your agent is doing all the work for you. If you have ever dealt with an insurance company directly, then you understand how difficult communication can be. Insurance brokers work hard to make your life easier. They get paid on commission, so they always work hard to guarantee that you are satisfied with their work. The last thing they want you to do is to switch agents.

Speedy Results : Getting quotes through an agent is just about as quick as getting them online. The main advantage of using an agent is that you get better service when making mid-period changes, requesting documentation and getting questions answered. If you don’t have an agent, your customer service query gets directed to a call center; the people in the call center don’t have the specialized knowledge that your agent has. It can take a real long time to get any results.

If you want fast and easy results, it is important to hire a good agent. Agents are there to take care of you; they work hard to make sure that you are always satisfied. When you shop for insurance online, you get stuck with inferior service.

Conclusion

A responsible person needs to have the appropriate insurance coverage in place. Before making a purchase, you must do your homework on each insurance plan to make sure it meets your needs and expectations. However, seeking a financial professional’s advice can help you pick the appropriate policy and level of insurance.