Our beloved dogs grow to become members of our families, and with that affection comes accountability for their welfare. Dogs, like people, may experience random medical conditions or mishaps that need veterinarian attention, which may be expensive.

By helping to cover these costs, pet insurance guarantees that your pet gets the care they require without breaking the bank. However, it could be challenging to search this market, given the quantity of pet insurance companies and coverage alternatives. You will get the information from this post to choose the best pet insurance package for your beloved dog.

What Is Pet Insurance Coverage?

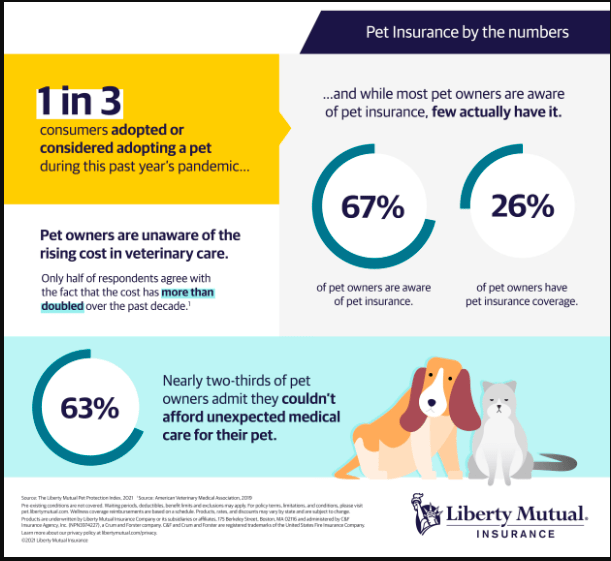

Source: Liberty Mutual Group

Pet insurance functions much like health insurance for people. The coverage of veterinarian bills resulting from diseases or accidents is exchanged for a monthly subscription. Nevertheless, pet insurance usually uses a reimbursement approach, unlike most human health insurance policies. In other words, you pay the veterinarian up front and then submit an insurance company claim to get your money back.

There Are Two Main Sorts of Pet Insurance Coverage

- Accident-only plans: These plans cover the costs associated with accidents, such as broken bones, cuts, or swallowed objects. They typically come with lower premiums but won’t cover expenses related to illnesses.

- Accident and illness plans: The average monthly cost for dog accident and illness pet insurance is $53 in the United States. These plans provide complete coverage, including accidents and illnesses like cancer, allergies, or chronic conditions. While they offer broader protection, they come with higher premiums.

Embedded video

Factors to Weigh When Choosing a Pet Insurance Plan

- Your dog’s age and breed: Younger dogs cost less and are typically healthier. Specific health concerns are more common in certain breeds, which may affect the cost of your coverage.

- Desired level of coverage: Consider your budget and your dog’s potential health needs. A more comprehensive plan might be wise if your dog is a high-energy breed prone to accidents.

- Reimbursement percentage: This is the amount your insurance company will pay back to you, usually between 50% and 90% of the vet cost. Although it comes with a greater premium, a higher reimbursement percentage reduces out-of-pocket expenses.

- Annual coverage limits: These limits cap the total amount the insurance company will pay out per year for covered conditions. Consider potential future medical needs when choosing a limit.

- Pre-existing conditions: Most pet insurance plans exclude coverage for pre-existing conditions, illnesses, or injuries your dog had before enrollment. Some plans offer limited coverage for pre-existing conditions after a waiting period, so check the policy details.

- Wellness coverage: Some pet insurance companies offer optional wellness add-ons that cover preventive care costs like vaccinations, spaying/neutering, or dental cleanings.

Verify the Credibility of Your Insurance Provider

Ensure that your chosen insurance company is reputable, doesn’t compromise the highest ethical standards, is experienced in pet insurance, and has a good performance history. There are always options to check online sources or hear what close ones say about it.

You should also ensure the provider is licensed and authorized to offer essential services in the state. In doing so, the different services are outlined after researching to determine which service is best suited for a pet.

Also, to ensure that you are not disappointed when it comes to accessing the best care for your pet, the insurance company must have responded adequately to any questions that you may have. They should also put in place an effective procedure for managing the claims that they make. It must be ensured that a claim is processed as early as possible, if necessary, properly.

Tips for Finding the Best Pet Insurance Deal

- Get quotes from multiple pet insurance companies: Always approach any plans presented to you with caution; do not simply jump at the first plan you encounter. They explain that you can compare quotations from different suppliers using suppliers’ quotation comparison tools.

- Read the policy details carefully: Before joining an insurance plan, the insured, learner, patient, client, or any beneficiary should know what is included, what is not, and any conditions that may apply.

- Consider your budget: Recurrent expenses should also be considered; what is the monthly cost of the insurance plan you opted for to cover your pet expenses?

- Feel free to negotiate: When selecting or comparing different policies, consider pet insurance options with varied plans and flexible premiums, depending on your number of pets.

- Customer service reviews: Identifying potential pet insurance providers’ customer service track is recommended records be identified so that the customer will be assisted fast and effectively in filing his claims.

- Policy lifetime limits: Depending on the specific plan, the coverage provided may limit the amount the insurance company will pay out over the dog’s lifetime. However, if you are likely to experience long-term health issues, a plan that lapses continuously might work better for you than one with lifetime limits.

Conclusion

Pet insurance programs for dogs are perhaps some of the best protections you require for your dog and your pocket. By getting to know the various coverage types and their necessity for your pet and evaluating the quotes offered, you can choose a proper plan for you and your dog. So, always consider that pet insurance is there to assist you in ensuring that your companion receives quality healthcare regardless of certain events.