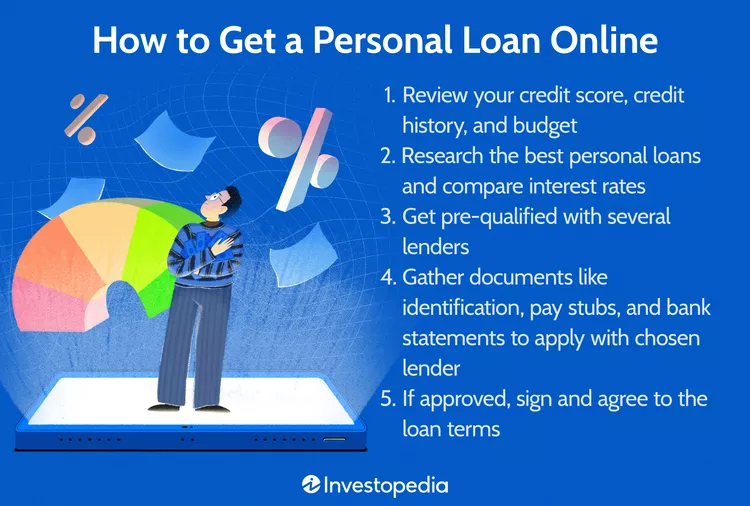

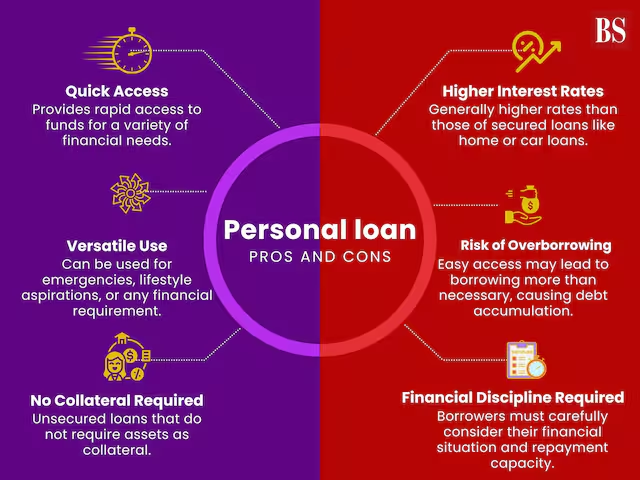

Personal loans provide quick access to cash for virtually any need, such as covering medical bills, consolidating debt, or financing home improvement. Although the process is straightforward, taking a few steps can help you select the right loan and improve your chances of approval. Here is how to apply for a personal loan online in easy steps.

How to Apply For a Loan Online

Check Your Credit Score

Your credit score is a big factor in the approval of a personal loan and the interest rate paid. Scores vary widely, but lenders group them into three categories:

- Excellent (800+): Best rates and higher amounts.

- Good (670-799): Competitive rates but less favorable compared to excellent.

- Fair (580-669): Many limited options with higher costs.

- Poor (Below 580): Fewer approvals and higher prices.

Improve your credit score before applying. Pay bills on time, decrease credit card balances, and refrain from applying for new credit accounts when not necessary.

Know How Much You Want

Determine exactly how much you need. This will affect your monthly payments, interest rate, and lender fees. Use a personal loan calculator to estimate your payments based on different loan amounts and terms.

Remember that some lenders charge origination fees, which are deducted from your loan funds. To avoid needing another loan to cover fees, factor these costs into your borrowing amount.

Review Lender Requirements

Lenders consider a few key factors to determine your loan eligibility:

- Credit Score: Minimum requirements vary, but many lenders prefer fair or better scores.

- Income: Steady and sufficient income increases your chances of approval.

- Debt-to-Income Ratio (DTI): A lower DTI shows you are not overburdened by debt.

- Collateral (for secured loans): Assets like cars or jewelry may be required for some loans.

Each lender’s criteria can differ, so research their requirements to focus on those most likely to approve your application.

Gather Necessary Documents

Lenders need documents to verify your identity, income, and address. Be ready to provide:

- Proof of Identity: Driver’s license, passport, or Social Security card.

- Proof of Income: Pay stubs, tax returns, or bank statements.

- Proof of Address: Utility bills, rental agreements, or property tax records.

Make sure all documents are clear and legible to avoid delays.

Explore Your Options

Personal loans come in various forms. Choosing the right one depends on your financial goals:

- Debt Consolidation Loans: Combine multiple debts into one payment, often at a lower interest rate.

- Home Improvement Loans: Pay for large renovation projects.

- Medical Loans: Finance large medical costs.

- Emergency Loans: For urgent expenditures, such as car repair.

- Wedding or Event Loans: These are for responsible financing of celebrations.

Determine whether you will require a lump sum loan or one that offers flexible access, such as the home equity line of credit (HELOC), so you may borrow as you need.

Compare Rates

Compare rates, terms, and fees from multiple lenders. Look for lenders that give you a prequalification where you can know your likelihood of approval and interest rate without having it affect your credit score. Avoid submitting applications to lenders that are not clear about their requirements or have hidden fees.

Select a Lender and Apply for a Loan Online

You now compare the options, selecting a lender that best satisfies your needs. Most lenders usually offer the opportunity to submit online or in person. These would require basic personal data, income information, and the purpose of the loan.

Please note that the offered loan might change as their documents review may change, which makes you request the lender explain why changes were made in the conditions given by that lender before accepting it.

Accept the Loan and Receive Funds

Once approved, review the loan agreement carefully and ensure you are comfortable with the terms. After signing, funds are typically deposited into your bank account within a few business days—sometimes even the next day for online lenders.

Manage Your Payments Wisely

Pay your loan on time every month. Setting up automatic payments can help you avoid late fees and may even earn you a discount with some lenders. Consider paying extra when possible to reduce your total interest costs and pay off the loan faster.

Tips for Success

- Double-Check Your Budget: Ensure the loan fits within your monthly budget.

- Avoid Short-Term Loans with High Payments: These may be harder to manage if your income varies.

- Improve Your Credit Score: If you are not in urgent need, work on your credit score to qualify for better rates in the future.

Conclusion

A personal loan can be a wise financial decision if planned carefully. By understanding your credit score, comparing lenders, and responsibly managing your loan, you can use this tool to meet your financial goals while minimizing costs.