Most of us are familiar with standard loans, such as vehicle, student, and home loans. These are usually long-term loans that can assist you with major expenditures. Nonetheless, an unconventional loan can be a better option if you simply need to borrow money temporarily or for a small sum.

Several different types of short-term financing are available. Money traps are common, so consumers should be cautious and thoroughly investigate any option and lender before signing up. A large number of predatory loans have short terms.

Below is a recap of the many different types of short-term loans.

Short-term Loan Types

Image Source: ceohangout

Depending on how much you need to borrow and how long you have to return the debt, you may pick from a wide variety of short-term loan alternatives. Their interest rates and the degree of risk they pose to the borrower also differ.

Installment loans

Individual loans are the most prevalent kind of short-term installment loans. This type of debt that is not secured entails requesting a loan from a bank, credit union, or internet lender. You have the option of selecting a payback period as short as six months, as well as the loan amount. There is typically no penalty if you return the debt earlier, even if the loan terms are just one or two years long.

Personal loans are frequently funded as soon as the same business day after they are accepted, depending on variables including your income, debt-to-income ratio (DTI), and credit score.

These unsecured loans might be used for debt consolidation, big purchases, or unexpected costs. After that, you will pay back the loan in equal amounts throughout the predetermined length of time, plus any interest.

Bridge loans

Bridge loans, often referred to as swing loans, are frequently utilized in real estate transactions. These gap loans can be backed by collateral or be unsecured, with payback lengths ranging from a few weeks to several years. They are well-liked by homeowners who just need to borrow money while they wait to get a longer-term loan arrangement. For instance, a person purchasing a new home but not having sold their previous one may use bridge loans.

Bridge loans may also be referred to as a type of hard money lending, in which the borrower pledges their property as collateral to get financing from a bank or other private investor. When purchasing, remodeling, or selling a property, hard money loans can help investors close the difference, but they sometimes have high interest rates, additional costs, and short payback terms.

Payday advances

Today, a lot of financial institutions provide their clients with advances based on anticipated wages, which are comparable to tiny short-term loans. You could be eligible to request up to several hundred dollars anytime you need the money if you have direct deposit into your account on a regular basis. Usually, the money must be returned when your subsequent deposit posts.

In many circumstances, these advance loans may be sought all the time, usually through a web platform or mobile app. Just a few minutes after approval, the money will be automatically sent to your account. You may usually “reuse” the function as much as needed once the short-term loan (as well as any associated fees) has been returned.

Payday Loans

Another option for a short-term loan backed by future income is a payday loan. Payday lenders provide these loans, which are often referred to as cash advance loans, with payback terms of one month or less.

The maximum amount you may borrow is determined by your past pay history and the local lending restrictions, which are often $500 or less. Payday loans, in contrast to other short-term financing choices, often don’t involve a credit check and aren’t reliant on your repayment capacity.

But beware: these loans usually include a fixed fee determined by the total amount borrowed. This can result in a costly annual percentage rate (APR) that is far into the triple digits, which consumer groups consider to be predatory. Certain states have maximum permitted fees. The State of New York outlaws them.

Car title loans

The title to your automobile serves as collateral for car title loans, much like payday loans do. In return for giving up your car title as collateral, these short-term loans—which are only accessible to those who own their automobiles outright, meaning there is no longer a lien on the vehicle—can provide you with rapid access to cash, often as much as 25% to 50% of your vehicle’s current worth.

Car title loans often have 15 to 30-day durations, much like payday loans. These loans, which include financing costs, origination fees, processing fees, and even document fees, are also rather expensive in the context of short-term loans. When taking into account how short this obligation is, the annual percentage rate (APR) on a title loan can rapidly approach triple digits.

Who can use a short-term loan?

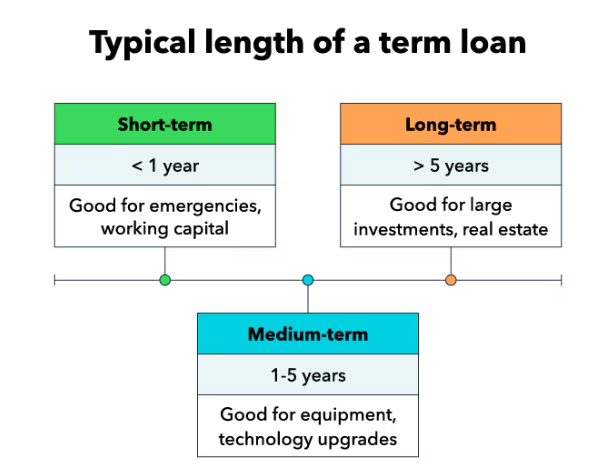

Image Source: Quickbooks

Short-term loans are targeted at people who need to borrow money for a brief period. These loans, whether secured or unsecured, can facilitate buying and selling a property, adjusting to a major relocation or change in employment, or handling a difficult financial period brought on by unforeseen costs.

Nevertheless, the maximum amount you may borrow from some of these products is far more constrained; for instance, many cash advance loans and payday advances have a maximum of a few hundred dollars. In addition, their interest rates may be unreasonably high compared to those of other loan types.

These loans have a shortened repayment period. Before taking a short-term loan, make sure you have the financial means to fulfill the payback obligations.

Conclusion

When an unforeseen medical cost or household need arises, short-term loans might help you meet your urgent financial demands. The majority of short-term loan choices have fees and interest charges that, although they may appear little, are significantly more than those associated with credit cards and other credit lines. When selecting your short-term loan and lender, it’s critical to take the full cost (and risk) into account.