The holiday season can be quite overwhelming, especially when it comes to money. As one report goes, Americans spent $886.7 billion on Christmas last year alone. With all the decorations, gifts, and celebrations, it is not hard to see why. But fear not! You can still enjoy the season without breaking the bank. The secret? A budget for Christmas set and stuck to.

Why You Need a Christmas Budget

It might seem like a lot of extra work, but having a Christmas budget is a game changer. It allows you to plan and avoid overspending, so you can enjoy the holiday without worrying about debt. Much like Kevin McCallister from Home Alone, you need a plan to tackle the season’s financial challenges – but no need for glue or swinging paint cans!

Holiday budgeting is simple: It is just a plan for your money. It helps you prioritize what is the most important and ensures that you are staying moderate. Here is how you can do it in three simple steps:

Step 1: List Your Monthly Income

Knowing how much money you make is the first step in making any budget. This covers both your normal income and any additional money you might get for the holidays from seasonal work, bonuses, or side jobs.

Step 2: List Your Monthly Expenses

Once you know how much money you make, it is time to map out how you will spend it. This includes every necessary expense that falls under your monthly needs, including:

- Giving: This generally amounts to 10 percent of your income.

- Essentials: Food, utilities, rent or mortgage, and transportation

- Other Essentials: Insurance, childcare, or debt repayments

- Extras: Dinners out, entertainment, and shopping.

Now is the time to make a list of all the holiday-related costs, including travel, food, décor, and gifts.

Step 3: Balance Your Budget to Zero

A zero-based budget is where every dollar has a job. After you write down your income and expenses, subtract them and ensure that the total equals zero. This helps you avoid having any “extra” money that might be spent without thinking. If you get a negative number, you will need to cut back on spending or increase your income so that everything balances.

If you end up with a positive number, congratulations! You can use that extra money to save for future goals or splurge on a bigger gift for someone you love.

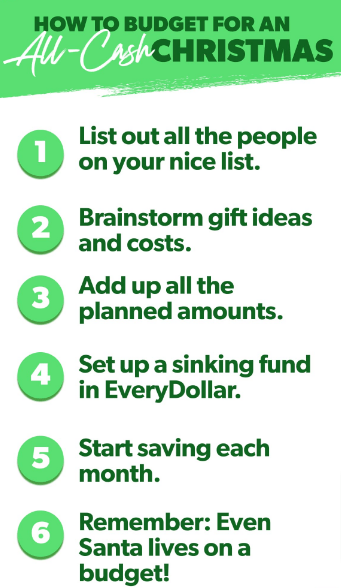

How to Set Up a Christmas Budget in EveryDollar

Creating your budget for Christmas is easier than you might think – and the EveryDollar budgeting tool can make it even simpler! Here is how to get started:

Set Your Christmas Spending Limit:

Based on your monthly income and budget, determine how much you can afford to spend this holiday season.

Remember that the average American family spends about $1,300 on the holidays, but you do not have to reach that amount.

Focus on what fits within your budget.

Create a Christmas Budget Category:

In EveryDollar, you can add a “Christmas Spending” category. This is where you will keep track of your holiday expenses. You can set up different lines for each area of your Christmas spending, like gifts, food, travel, and decor.

Break It Down by Person or Item:

For gifts, list everyone on your gift-giving list, including friends, family, and coworkers. Decide how much to spend on each person. Do not forget to include budget lines for food, travel, and decorations. If you are planning big holiday meals or traveling to visit family, account for those expenses, too.

Track Your Spending:

To stay on track, you must monitor your spending. Enter every expense in EveryDollar when you make it. This will prevent overspending and hold you accountable.

How to Find Extra Cash for Christmas

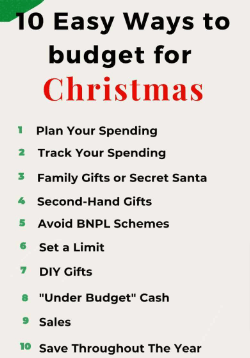

Now that you have your budget and savings plan in place, it is time to think about how you can find additional money for Christmas. Here are some tips:

Trim Your Regular Budget:

Look for areas where you can temporarily cut back. You might skip a few restaurant meals, buy fewer clothes, or cancel optional subscriptions. Use coupons and shop smarter to save on groceries and other expenses.

Increase Your Income:

If you need a little more cash, consider getting a part-time job. You might sell homemade goods, babysit, or work more hours at work. Selling things you no longer need or use is another option.

Get Creative with Gifts:

Instead of splurging on expensive gifts, create homemade presents or give the gift of experiences rather than material goods. Homemade presents can be meaningful, often at a much lower cost.

Will a Christmas Budget Really Save You Money?

Absolutely! Budgeting for Christmas will not only keep you from overspending, but you will feel relaxed and be able to enjoy the holidays much more. A budget helps a person make good use of what he has and ensures that he is well on top of his finances.

Remember, the point of Christmas is to celebrate with loved ones, not to stress over money. By planning and sticking to your budget, you will have a merry, stress-free holiday – and a happy, financially secure New Year!