When you are in your right mind, you can plan ahead for the future, but what happens if you become ill? This article examines the benefits of estate planning and guides readers through the five phases of estate planning.

What estate planning is.

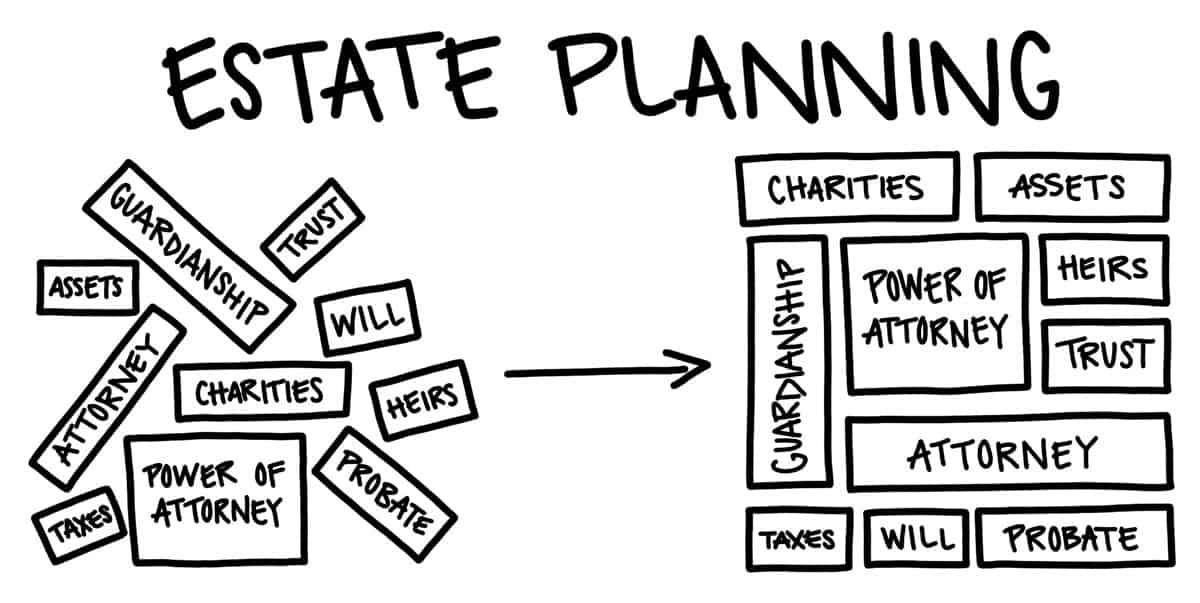

Estate planning is the legal process of preparing for the management and disposal of your assets in the event of your death. The estate planing ensures that your wishes are fullfilled after your death. There are several different elements that can be included in an estate plan, including:

Wills: A will is a legal documention that sets out how you would like your assets to be distributed among your loved ones after your death. You can use the will to appoint a guardian for minor children.

Trusts: A trust is basically the legal arrangement that control how your assets are managed and distributed. Many different purposes of Trusts includes asset protection, tax planning, and avoiding probate.

Powers of Attorney: A power of attorney allows you to appoint someone else to make financial on your behalf if you are unable to do it yourself.

Advance Directives: Advance directives are legal documents that allow you to express your wishes regarding end-of-life care in the event that you are unable to communicate those wishes yourself.

Why estate planning is important.

Estate planning is important because it can help protect your family and your assets in the event of your death. Without a right estate plan, your loved ones may go through the process, which can be lengthy and expensive. An estate plan can also help you designate how your assets will be distributed after your death and can even provide for tax savings.

What should be included in an estate plan?

An estate plan is a very important legal document that everyone should have. It outlines what will happen to your assets and possessions after you die. Having not an an estate plan in place, the state will determine how your assets will be distributed.

Some of the most important things in an estate plan are:

- – who will inherit your assets and possessions?

- – how will your debts and taxes be paid?

- – who will take care of your minor children if you die?

- – what kind of medical treatment do you want (or not want) if you become incapacitated?

Making an estate plan can seem daunting, but taking the time to do it is important. You can always chnage your estate plan as your life circumstances change.

Who should draft a will?

Most people think that only wealthy individuals need to draft a will, but this is not the case. Anyone who has minor children and owns property should have a will. A will allows you to control how your property is distributed after your death. If you die without a will, your property will be distributed according to the laws of your state.

If you are thinking about drafting a will, you should consult with an attorney who specializes in estate planning. They can help you determine what assets you need to include in your will and how to best protect your loved ones.

How do I choose an executor?

While choosing an executor for your estate, you should consider someone who is responsible and organized. This person will be in charge of carrying out your wishes after you pass away, so you want to make sure that they are up for the task. You should also consider someone who lives close to you, as this will make the process easier for them.

Do I need an attorney to draft my will?

There’s no set answer to this question – it really depends on your personal circumstances and preferences. You may feel comfortable drafting your own will if you have a clear understanding of your assets and how you need them to be distributed after your death. However, if you have a complicated financial situation or you’re not sure where to start, you may consult with an attorney. An experienced estate planning attorney ensures that your will is properly written and executed and offer guidance on other estate planning matters, such as trust protector provision and tax planning.

Why the use of a Power of Attorney and a Living Will are essential for your estate plans

There are a few key reasons why utilizing a Power of Attorney and Living Will are important for your estate plans.

Having a Power of Attorney allows you to name someone you trust to make financial and legal decisions on your behalf if you become incapacitated. This can be an extreme peace of mind for you and your loved ones, as it provides a clear plan for who will handle your affairs if something happens to you.

In addition, a Living Will allows you to express your wishes regarding medical treatment in the event that you are unable to communicate yourself, ensuring that your end-of-life wishes are carried out exactly as you desire.

Conclusion

Estate planning is an important process that everyone should go through in order to ensure their assets are distributed according to their wishes. While it is a daunting task, getting started is the most important part. By having a clear understanding of what you want and need, you can then begin to put together your estate plan with confidence. If you have any questions, be sure to consult with a qualified attorney or financial advisor to guide you through the process.