Debt consolidation, the act of combining many loans into one, may help you see your finances more clearly, pay less in interest, and experience less financial stress.

One way to conceptualize debt consolidation is as a kind of first aid for those who have taken on excessive debt and need assistance paying it off. However, having fewer debts might improve other aspects of your financial situation and ease your burden.

You should frequently assess your debt status for possible areas of improvement, just as corporate leaders must routinely analyze their balance sheet for possibilities to consolidate or lower the firm’s debt load.

Find out the things to remember when you review your personal balance sheet.

The Process of Debt Consolidation

Image Source: Credello

There are a number of methods to roll over existing debt into new debt, including getting a home equity loan, a new credit card with a high enough credit limit, or a new personal loan. Next, you use the new loan to settle your earlier, lesser debts.

You can move the amounts from your previous credit cards to your new one, for example, if you are using the new card to pay off existing credit card debt. Certain credit cards that facilitate balance transfers also provide bonuses, including a temporary 0% interest rate on the transferred amount.

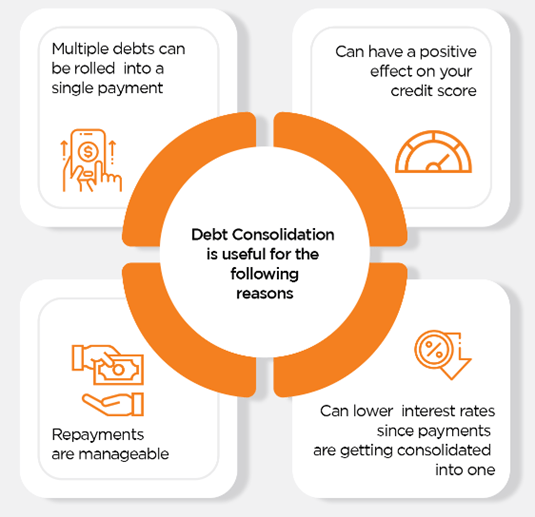

Debt consolidation can help you simplify your finances by reducing the number of bills you have to pay each month and the number of deadlines you have to remember. It can also result in lower interest rates and smaller monthly payments.

How to Be Eligible for Debt Consolidation

Image Source: Cashe

To be eligible for a new loan, borrowers must fulfill the income and creditworthiness requirements set forth by the lender. For instance, you could be required to submit letters from creditors or repayment agencies, two months’ worth of credit card or loan bills, and an employment letter in order to be eligible for a debt consolidation loan.

Things to Think About

What Are Your Interest Rates?

You shopped around and obtained the greatest interest rate on each loan when you took it out. Now that some time has elapsed, and the going rates might have altered, it could be time to reevaluate your loan.

Even though interest rates have generally increased recently, if your credit score has increased over time, you may be able to get a better interest rate on your loan. The total amount of interest you would pay may be reduced if you combined all of your loans into one with a competitive interest rate.

Stress Level in Money

When you consolidate your debts, your management of many accounts is streamlined. However, the dates and payment options for any debt you may have, including credit card debt, may vary. You will only need to monitor one payment date and transaction every month.

Consolidating your debts may not be the best option for you if it results in a higher interest rate or a single payment that will be difficult to make each month. With the assistance of your financial advisor, you can better grasp your alternatives and how they fit into your overall financial plan.

Which Debt Consolidation Loans to Take Into Account

If you are trying to consolidate, you have a few possibilities.

While unsecured loans—such as conventional bank loans—generally carry the least risk to your other assets, you might need to have excellent credit to qualify for the lowest rates.

They could also come with more costs than some other choices, such as loan fees, higher interest rates, and a drawn-out application and documentation procedure.

Rates on secured loans are often lower than those on credit cards. Examples of these loans include home equity lines of credit. For example, if your property qualifies for a cash-out refinance or a home equity line of credit, you may be able to use your mortgage to pay off debt. However, keep in mind that there is a chance you might forfeit the underlying collateral if you are unable to make loan payments.

A credit card that allows for a debt transfer with little or no interest is one choice that some borrowers take advantage of. Even if it can be a less complicated and more affordable alternative, you should have a strategy in place to pay off the debt before the introductory period ends. If not, you risk paying an even higher interest rate on the outstanding balance.

Finding Better Interest Rates on Loans

Securities-based loans (SBLs) are an additional kind of secured loan that may be helpful for debt reduction. With this kind of loan, qualifying investors in a portfolio can be used as collateral to help qualified borrowers get a line of credit. In comparison to the loans you are combining, it can provide better rates.

Your payback timeline may be more flexible with an SBL than with other loan kinds, which is another possible benefit of combining other debt. For example, instead of making monthly payments for interest and principal, you could be eligible to have interest rolled into the principal as long as you retain adequate collateral.

Getting a Wider Perspective on Your Finances

Discussing your loan alternatives with the firm that already manages your savings account or investment portfolio may allow you to receive multi-product discounts or other benefits. Your financial advisor should be aware of your loan obligations to get a complete picture of your finances and recommend the best course of action to assist you in fulfilling your financial needs.

If you are considering consolidating your debt, consider the time, money, and stress savings, as well as the potential improvement in your overall financial situation.

Is Your Credit Score Affected by Debt Consolidation?

Because it results in a credit inquiry, debt consolidation may have a short-term negative impact on your credit score, but if used properly, it can improve your credit score over time. When they reduce their credit usage ratio and prevent missing payments, most consumers who make their new payments on time notice a considerable rise in their credit score.

What Risks Are Included in Debt Consolidation?

There are several drawbacks to debt consolidation as well. Getting a new loan may somewhat lower your credit score, which may make it harder for you to get approved for additional loans in the future.

In the long term, consolidating debt may result in higher payments, especially if you pay off your credit card debt but keep using the cards you paid off. Your credit score can also temporarily take a hit.

There’s also a chance that the way you consolidate your loans can increase the overall interest you pay. For instance, you can pay more interest overall over time if you take out a new loan with lower monthly payments but a longer repayment period.

Conclusion

Consolidating debt might be a smart way to lower your total interest expenses and pay off debt faster. Several options exist, including using a home equity loan, a personal loan, or a new credit card.

The amount you must pay off, your capacity to afford it, and your eligibility for a reasonably priced loan or credit card will all determine the best approach to consolidate your debt.