A bank account keeps your money safe. Banks also allow you to earn interest on your deposits, which helps you multiply your savings or investments.

Four types of banks operate in India: foreign banks, cooperative banks, public sector or nationalized banks, and private banks. Indian nationals can open bank accounts with any of these four types of banks.

You must be aware of the sorts of bank accounts that each of the four categories of banks offers in order to choose one that meets your needs.

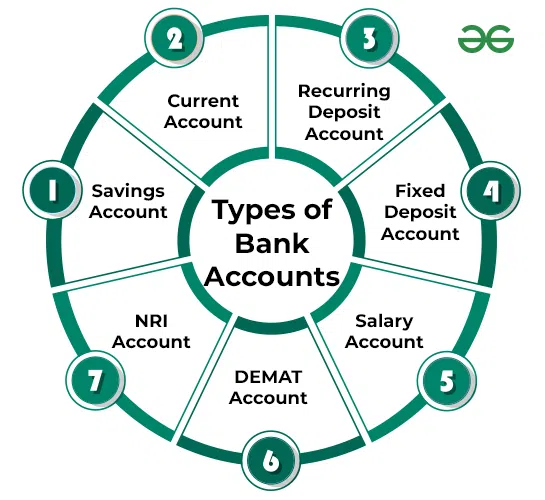

Five Types of Bank Accounts

There are five types of bank accounts that you can select from:

Image Source: GeekforGeeks

#1. Savings Account

These deposit accounts are intended to assist customers in saving money. Anyone in India with an Aadhaar card and a PAN card—both required to create a bank account in India—can open a savings account.

Key Features of a Savings Account

Limit: An account designated for savings can hold an infinite amount of money to avoid bankruptcy. The overall quantity of transactions may be limited, depending on your bank.

Equilibrium: For a savings account to remain open, a customer must typically have a minimum required amount.

Certain accounts, such as savings accounts created under the Pradhan Mantri Jan Dhan Yojana (PMJDY), the Indian federal government’s financial inclusion program, are exempt from the minimum balance criteria.

Under PMJDY, each person is only allowed to create one zero-balance savings account. These accounts are classified as Basic Savings Bank Deposit Accounts, which have monthly withdrawal caps of four, including ATM withdrawals and deposit limits of both quantity and value.

Interest: The customer receives interest when funds are placed into a savings account. The interest rates offered by various institutions vary. For example, the biggest public sector bank in India, State Bank of India, offers 2.70% interest on savings bank deposits for account balances up to INR 1 lakh. For accounts with a balance of less than INR 50 lakh, HDFC Bank—the largest private sector bank in India—offers a 3% return on savings bank deposits.

Advantage: The simplest way to generate interest on idle funds held in banks is through savings accounts.

#2. Current Account

The majority of current accounts are company accounts used for regular money transfers between other bank accounts. The transactions made by companies and company owners for routine business operations are most appropriate for these accounts.

Key Features of a Current Account

Limit: A current account may accept an infinite quantity of money as deposits. Moreover, current accounts are unrestricted in terms of transactions.

Equilibrium: A current account has a greater minimum balance requirement than a savings account.

Interest: Current account holders do not receive any interest.

Advantage: Thanks to the overdraft feature, customers can withdraw more money from these accounts than is actually in the account.

#3. Salary Account

Image Source: Wiki

Banks create these accounts at the request of large enterprises and businesses that use banks to pay their personnel. Every worker has the right to have a salary account to which their employer credits their pay each month.

Key Features of a Salary Account

Limit: An unlimited amount of money can be deposited into a salary account. Salary payments to each employee are determined by how much each employee disburses. Employees can conduct independent transactions from one type of bank account to another.

Equilibrium: Employees with salary accounts can withdraw the whole amount credited to the account at any time, as they are zero-balance accounts.

Interest: Salary accounts do not provide interest for employees.

Advantage: These accounts can be converted to savings accounts at any moment. Banks can convert them into savings accounts, which are subject to different regulations if they remain dormant for more than three months.

#4. NRI Account

Non-resident Indians who want to have a bank account in India for financial purposes open these accounts. NRI accounts may be opened in three different types:

Non-Residential Ordinary Account (NRO)

These accounts hold funds in Indian rupees. The deposit was made from proceeds from sales made in India.

Key Features of an NRO

Limit: Money can be deposited into an NRO account indefinitely.

Equilibrium: It is possible to keep any level of equilibrium.

Interest: What is taxed is the principal amount as well as the interest that is earned on that principal.

Advantage: The rate of conversion has little bearing on these accounts. An NRI can use the NRO account to open a savings account, current account, or fixed deposit account.

Non-Residential External Account (NRE)

Rupees from India are deposited into these accounts. But the money deposited comes from savings or earnings from the country where the non-resident Indian resides, not from profits earned in India.

Key Features of an NRE

Limit: The amount of money that may be deposited into an NRE account is unlimited.

Equilibrium: It is possible to maintain any level of equilibrium.

Interest: Neither the principal amount nor the interest accrued on it are subject to taxation.

Benefit: These accounts feel any future adjustments to the conversion rate. An NRI can open a savings account, current account, or fixed deposit account using the NRE account.

Foreign Currency Non-Residential Account (FCNR)

The Reserve Bank of India, the country’s central bank, has allowed the currencies that can be deposited in these accounts. Any person of Indian heritage or Non-Resident Indian (NRI) may maintain deposits in a currency that has been authorized and is meant to produce revenue.

Suppose revenue is earned in a currency that is not on the permitted list of currencies. In that case, a suitable currency is chosen for the conversion of the earnings or profits to be deposited. Banks are indicated by the letter (B) in FCNR accounts, commonly called FCNR (B) accounts.

Key Features of an FCNR

Limit: An FCNR account may accept an infinite amount of money as deposits.

Equilibrium: You can keep any balance at all.

Interest: The principal and the interest generated on it are not included in the taxable category.

Advantage: These accounts feel the impact of a potential change in the conversion rate. Through the FCNR account, an NRI may only open fixed deposit accounts with a one-year minimum maturity.

#5. Recurring Deposit (RD) Accounts

Deposit accounts are opened by customers who wish to earn interest on their funds. The easiest way to make more money than savings accounts may offer is to open a registered deposit account, or RD.

Key Features of a Recurring Deposit

Limit: Depending on the bank, there are different minimums for opening RDs. Consumers are free to open an RD account with any bank and set a minimum monthly balance as low as INR 1,000.

Balance: Reverse deposit accounts (RDs) enable users to withdraw a monthly quantity that is predetermined at account opening.

Interest: Every month, a certain sum is taken out and deposited into the RD account, where it accrues interest. Savings account interest is frequently lower than this rate.

Advantage: The RD is a financially advantageous option for consumers due to its variable term. Customers who deposit money in an RD can choose to receive interest on the amount placed for as long as six months or as long as ten years. Before the term expires, RD accounts can be closed without losing accrued interest.

Conclusion

Both public and commercial banks design banking specifically to meet the needs of varying age and gender demographics, enabling all citizens to become financially capable.

The country is moving toward financial inclusion in modest but significant stages, and increasing public awareness and understanding will be crucial to bolstering its efforts to prosper.