Effective accounting is the foundation of both financial development and stability. Among the other options on the market, Xero stands out as a top cloud-based accounting software option for companies of all sizes.

Xero offers efficient financial management solutions and is a better option than traditional bookkeeping techniques because of its user-friendly interface and broad feature set.

You’ve come to the correct place if you’ve been thinking about using Xero for business and would need additional information about how to do so. The advantages of Xero and the value it can provide to your company will be discussed in this article, along with some practical pointers and advice to get you going.

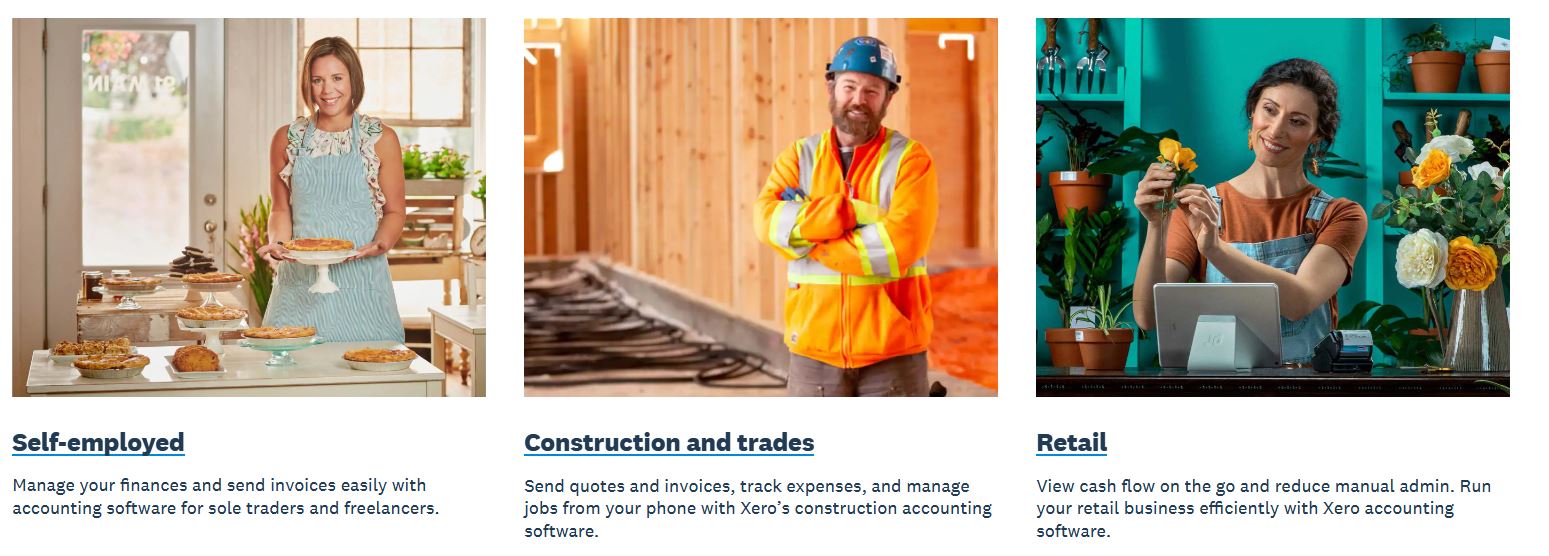

Can small businesses benefit from Xero?

Image Source: Xero

Yes, Xero is a great fit for small enterprises. Its expandable features, inexpensive price, and easy-to-use interface make it the best option for efficient money management. Xero offers tools for managing expenses, creating invoices, and financial reporting that help small businesses expand and improve efficiency.

Key Elements of the Xero

Image Source: Xero

The primary attributes of the Xero invoicing module are as follows:

Create recurring bills.

Recurring invoices may be automatically created, saved, and sent from Xero.

Send invoices in bulk.

You may email one invoice at a time or send all of your bills at once.

A mobile invoice

As soon as you complete a task, you can now generate and submit online invoices from your phone.

Payment immediately

Allowing invoices to be “payment-enabled” is one of Xero’s greatest features.

The consumer may then click and use any major debit or credit card to make an instant payment after it has been received. To integrate Xero with payment gateways, you can use Stripe, GoCardless, or another.

Chargeable costs that are chargeable on demand.

Through your consumers’ payment, you may now get reimbursement.

Replicate the previous bill.

Reproducing your previous invoices, adjusting the quantity or description, and sending them will save you time.

Multiple currencies

A customer can be invoiced in many currencies or GBP. If the invoice is multi-currency, Xero automatically tracks any exchange gain or loss.

Statement of accounts

The client account statement may be sent straight from Xero as well.

Notes of credit

You may write and send credit notes to your clients immediately, just like invoices.

Xero’s Potential Benefits for Businesses

Xero provides organizations with a multitude of advantages that improve financial management and spur development.

Enhanced Financial Transparency and Management

With Xero, businesses can see their financial situation in real-time. Business owners may use configurable reports and user-friendly dashboards to manage spending, monitor cash flow, and identify financial patterns. Proactive financial management and well-informed decision-making made possible by this visibility ensure stability and expansion.

Automating Accounting Tasks to Save Time

Xero automates routine accounting processes like bank reconciliation, expenditure tracking, and invoicing. Automating repetitive procedures can save businesses time and money. Additionally, by streamlining data input and removing human mistakes, Xero’s interfaces with banking institutions and third-party apps improve operational efficiency.

Improved Cooperation with Advisors and Accountants

Xero facilitates seamless collaboration between companies and their accountants or financial consultants. The software facilitates real-time cooperation on financial chores and safe data exchange. Accountants can guarantee compliance, give strategic counsel, and offer timely insights, resulting in a fruitful collaboration that propels corporate success.

Scalability to Support Business Expansion

Because of its scalability, Xero is perfect for companies of all sizes, from startups to large corporations. As businesses grow and change, Xero offers flexible plans and scalable features to meet their evolving needs. Xero gives businesses the resources and assistance they need to thrive, whether they are managing an increasing clientele, growing their operations, or breaking into new markets.

Smooth Combination with Office Instruments

Numerous company applications and tools, such as project management platforms, CRM software, and e-commerce systems, are easily integrated with Xero. This connection improves overall productivity by removing data silos and streamlining workflow procedures.

These advantages allow companies to streamline their financial processes, spur expansion, and gain a competitive advantage.

Some Advice and Top Techniques for Using Xero Well

Establishing Accounts and Personalizing Settings: Organizations should set aside time to correctly set up Xero accounts and modify settings to meet their unique reporting needs and financial specifications.

Frequently Reconciling Bank Transactions: Accurate financial records in Xero depend on timely reconciliation. To guarantee that the system displays the most recent economic data, reconcile bank transactions on a regular basis.

Using Reporting Tools for Insights: Xero provides a range of reporting templates and tools that may be used to gain insightful knowledge about trends and financial performance. To make wise company decisions, create and evaluate reports on a regular basis.

Connecting Xero with Complementary Business Tools and Apps: Link Xero with supplementary business tools and apps to improve workflow effectiveness and simplify procedures within the company.

Bookkeeping Outsourcing: Take into account hiring virtual assistants or expert services to handle your bookkeeping needs. To guarantee accuracy and efficiency, pick a trustworthy outsourcing partner like Wishup and assign bookkeeping tasks wisely.

Benefits of Outsourcing Bookkeeping with Xero to a Virtual Assistant

Using Virtual Assistance to Simplify Bookkeeping Tasks: Companies may streamline their bookkeeping procedures by utilizing virtual assistants who have received Xero training. Within the Xero platform, virtual assistants support the management of financial transactions, account reconciliation, and proper record-keeping.

Advantages of Hiring a Virtual Assistant to Manage Your Accounting: Hiring a virtual assistant to manage your accounting has several advantages for your company, such as cost savings, scalability, and access to specialist knowledge. By taking on the administrative strain of bookkeeping, virtual assistants free up business owners to concentrate on their primary responsibilities and long-term goals.

How Virtual Assistants may Help Xero: Virtual assistants skilled with Xero may help with a variety of duties, including financial reporting, bank reconciliations, data input, and invoice processing. They ensure that data is accurate, accounting standards are followed, and bookkeeping tasks are completed on time. This helps the organization’s financial operations and decision-making processes run more smoothly.

Conclusion

The capabilities of Xero’s expenditure tracking and reporting software provide unmatched precision and efficiency in handling financial transactions. Businesses may benefit from increased financial visibility, better advisor cooperation, and scalable solutions for future expansion with Xero.

We urge companies to investigate Xero’s advantages and consider hiring virtual assistants to do their bookkeeping. Make an appointment for a free consultation with our staff right now to learn more about how virtual assistants may help you manage your finances better.